In our previous post “Northern Arc – Creating & riding the NBFC wave”, we discussed that Northern Arc is a unique play on high yield lending businesses in India like personal loans, business loans, microfinance loans and small LAP loans. Two quarters have passed since, let us reassess the investment hypothesis:

Section 1: Changes in the macro set-up

Raw material: Thanks to the RBI rate cut, borrowing costs for most NBFCs including Northern Arc has declined by 10-30bps. This is a net positive for the entire NBFC ecosystem.

Growth & asset quality prospects: While system loan growth has improved from lows of 9.5% in Oct25 to ~11-13% in Dec25, the trends are still divergent across the various sub-segments of high yield lending ecosystem:

- Personal loans – Growth has started picking up after 18 months of caution

- Business loans – Good traction across various geographies

- Microfinance – Degrowth phase is over, growth phase started from Q3FY26

- Small LAP loans – Still in cautious mode, worst to be over by Jun26

Section 2: Performance of Northern Arc

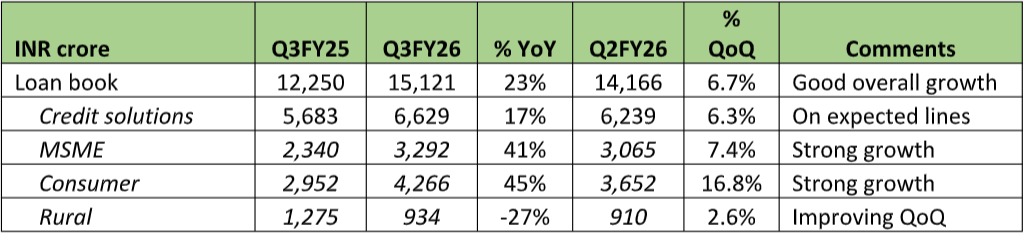

Northern Arc posted strong loan book growth for the December quarter, with MSME and Consumer segments growing at the fastest pace. While rural (microfinance) de-grew on YoY basis, it has started growing on QoQ basis, inline with other good players in the segment.

Table 1: Strong asset growth

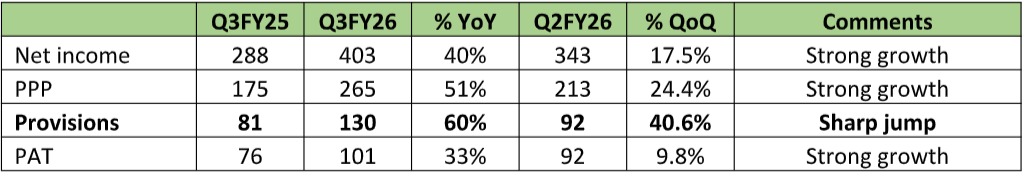

When one looks at the income statement, we see strong growth in every parameter. As investors in Banks & NBFCs, we like strong growth in income & profits, but we would want to dig deeper into the increase in provisions to see if there are any signs of asset quality stress.

Table 2: Strong income growth, but higher provisions

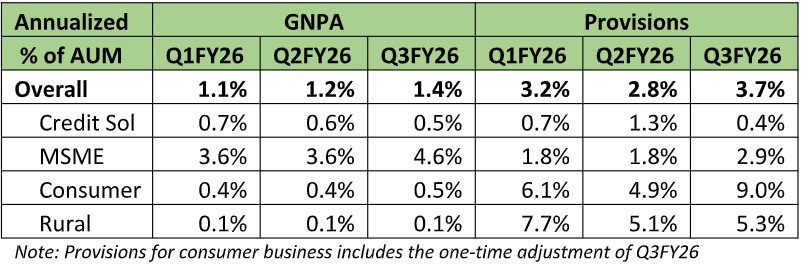

While there are multiple ways to analyze asset quality, the two most popular and relevant ones are GNPAs and Provisions. In case of Northern Arc, GNPA as a metric is useful only for its Credit Solution Business, and the LAP portfolio of its MSME business. This is because it has a very strict policy of write-off or 100% provisioning in its unsecured businesses of microfinance, merchant part of MSME business, and consumer business. Thus, in case of Northern Arc, it is better to look at provisions (loss as % of loan book). If we analyze the provision trends of the past three quarters, we realize that:

- Improvement – Credit Solutions

- Stabilization – Rural (Microfinance)

- Deterioration – MSME & Consumer

Table 3: Asset quality performance

Section 3: Deeper analysis into asset quality

Ideally, one would have concluded that Northern Arc is witnessing deterioration in two out of its four businesses. Pain in LAP part of MSME business is understandable, since small LAP segment is going through a painful period for everyone like Five-Star, Jana Small Bank, etc. But what about the Consumer business & the merchant part of its MSME business? Since these two businesses are not the regular lending, it makes sense to dive a little deeper.

In the Consumer & merchant MSME business, Northern Arc directly lends to the customers of its Fintech partners like Paytm, PhonePay, EarlySalary, KreditBee, Moneyview, etc. Since RBI allows these Fintech to provide only 5% FLDG i.e. guarantee to cover losses, Norther Arc has adopted risk- based pricing strategy here i.e. it will price the loans at higher yields if there is higher risk of defaults, thus ensuring that it is able to earn stable profits in the vicinity of 3.0-3.5%.

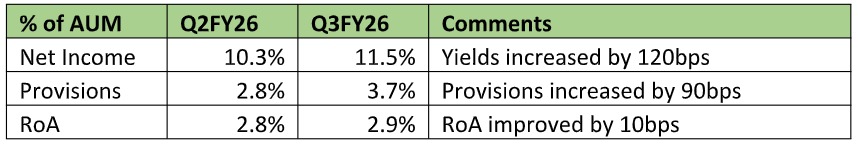

If the above risk-based pricing model is indeed working for these two businesses, the following should get reflected in reported numbers:

- If yields increase in any quarter, the provisions will also increase

- If the yields decrease in any quarter, the provisions should also decrease

- Net impact on profits should be minimal (RoAs)

Table 4: Higher yield, higher provisions, but stable overall profitability

While the company does not report segment wise income statement, the above logic seems to be broadly working in Q3FY26. There was strong growth in Consumer & merchant part of MSME. As a result, overall yields have expanded and provisions have increased (we know that biggest jump in provisions came from MSME & Consumer businesses). On the concall, the company reported that there was a one-time income of 20cr and one-time provision of 23cr in consumer business, which again corroborates our theory “risk-based pricing”

Section 4: Where do we go from here

Northern Arc reported strong growth in profits and gave a good outlook in its concall. Yet, the stock price corrected by almost 10% since the results have been declared. In fact, it is now trading at 1.0x on current book value. No NBFC which is growing above 20% and delivering 3.0% RoAs are trading at such low valuations. While it is never possible to know the exact reasons, below are some of the guesses:

- General weakness in small cap stocks

- Lack of identifiable promotor and periodic rumors of a large existing investor trying to sell

- Analysts & Institutional Investors not warming up to the stock due to

- 1. Risk aversion to high yield lending businesses

- 2. Northern Arc is yet to taste success in direct retail lending businesses like microfinance & small LAP

- 3. Not being able to fathom the quarterly volatility in provisions in consumer & MSME business of Northern Arc

We have tried to address the last concern i.e. quarterly volatility in provisions in consumer & merchant part of MSME business. If our understanding is correct, overall provisions will keep fluctuating between 2.7-3.3% corridor, depending upon what opportunities come in the consumer & merchant MSME business but RoAs will remain stable in the 2.7-3.3% range in every quarter for the next few years. With the passage of every quarter, more investors & analysts will start appreciating the concept of “risk-based pricing”.

Disclaimer:GreenEdge Wealth Services LLP is SEBI registered investment advisor. However, the above article has been written for educational purpose and should not be construed as an investment advice. As a part of our advisory activities, we have recommended equity and debt instruments of some of the companies discussed in this article to our clients as well as for our personal investment portfolios. The readers are requested to do their own due diligence.