STORY – ROTO PUMPS

Past track record, future expectations and current valuations are three most important ingredients of our stock recommendation process. We recommend a stock when it scores high on each of these parameters and has an annualized return potential in excess of 18%. Once we have recommended a stock, we continue to track its business performance as well as price performance. Based on how these variables pan out, we classify our past recommendations into two categories:

Stock Ideas:

These are stocks where the underlying business performance of the recommended company was at par or better than our expectations. Needless to say, that stock returns in this case would be higher than our internal annualized target of 18%

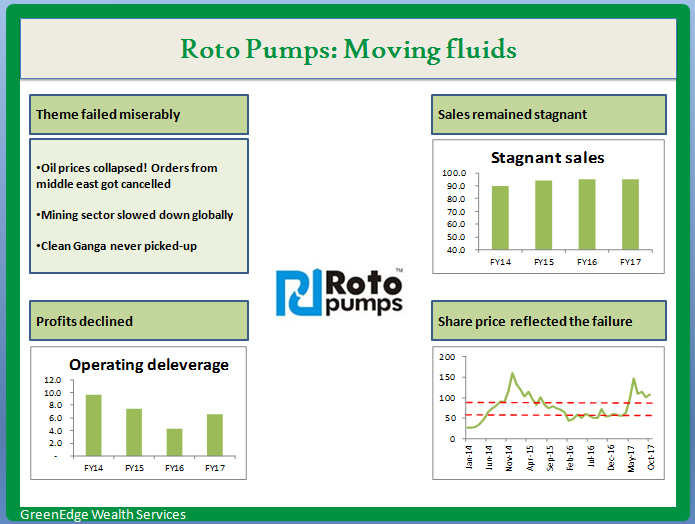

Our Laggards:

These are stocks where the underlying business performance of the recommended company was below our expectations. Obviously, the stock price performance would also be sub-par in comparison to our internal annualized target of 18%