Most NBFCs have a simple business model – on one side, they borrow money from banks & bond markets. On the other side, they lend that money to customers wanting to expand their business (gold loan, MSME loan, LAP loan) or to customers willing to purchase an asset (home, car, truck, bike, tractor) or to customers who want to go shopping (personal loans). Like most other NBFCs, Northern Arc too borrows money from banks & bond markets. But on the lending side, its business model is little unique since it lends in three different ways:

- Lending to other smaller NBFCs (whom banks are not keen to lend)

- Lending to customers of other smaller NBFCs &Fintechs(in partnership)

- Lending directly to customers (like other NBFCs)

Business 1 – Lending to other smaller NBFCs

Opportunity: A large country like India has approximately 9,000+ registered NBFCs. But the risk aversion amongst Indian banks is so high that only the top-50 of these NBFCs get uninterrupted &direct funding from banks (loan book size > 5000cr). There are many credible promoters & business models within the next 300 NBFCs and they are always starved of raw material i.e. borrowings.

The early days: Northern Arc sensedan opportunity in the microfinance (MFI) sector after the AP crisis of 2010, when banks had completely stopped lending. Northern Arc would identify well run MFIs, lend to them from its own balance sheet, and arrange funds for them via the investor route. Over the years, Northern Arc kept on adding small NBFCs operating in sectors like MSME, Consumer, Vehicle, Affordable Housing & Agriculture. These sectors witnessed multi-fold growth and so did Northern Arc’s loan book.Another feather in the cap was its early identification of Fintech sector in 2016, building expertise around it, and starting partnership-based lending with Fintech based NBFCs, and becoming the sub-sector leader.

Right to win: One may ask as to what is unique about a large NBFC lending to smaller NBFCs? The simplest way to check if there is any uniqueness to what Northern Arc is doing is to see if a lot of other NBFCs have been successful in doing this. We find that it is only Northern Arc and to some extent MAS Financial who have been able to scale this model.

Northern Arc has built its uniqueness by creating an ecosystem – One side, they have a team of 200+ professionals who identify worthy NBFCs, monitor them on a regular basis, understand the business cycle of the underlying customers, and structure the deal. On the other side, they arrange funds for these small NBFCs either though their own balance sheet or through their own bond fund, or their large network of institutional investors, family offices, AIFs, etc (placement business). The success of this ecosystem can be gauged from three things:

- Their credit losses in this business over the past 10 years have been less than 50bps.

- If Northern Arc has appraised & lent to a small NBFC, there is a good chance that other large NBFCs & small banks will also lend money to that small NBFC.

- Over the past few years, there has been good demand from large banks, NBFCs and Investors (MFs, AIFs, HNIs) to buy these loans from Northern Arc. This has given rise to “originate & sell model” which results in generation of good fee income and is also light on balance sheet.

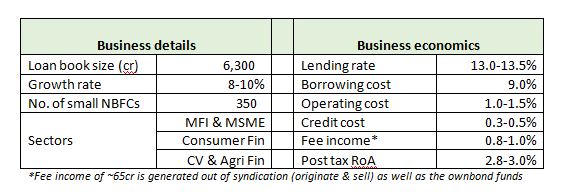

Economics & future growth: Northern Arc now has lending & fund-raising relationship with 350+ small NBFCs and newer NBFCs keep on getting on-boarded every month. The economics of this business are also reasonable, as can be seen below (would have generated 160-180cr of profit in FY25). The only question that remains is why is the growth rate in this division at 8-10% only?

Whenever Northern Arc lends to a small NBFC, it has three options – to keep the loan on its own balance sheet or place the credit to large banks/NBFCs/mutual funds/AIFs/family offices/HNIs, or participate through its own bond funds. Keeping the loan on its own balance sheet will block the precious equity capital while placement or participating through own bond funds will earn fee income and free up the equity capital. Norther Arc has decided to grow its own balance sheet by only 8-10% and focus more on fee generating businesses i.e. placement & own bond fund. As a result of this, growth in this division will look optically lower but RoEs will keep improving.

Business 2 – Lending to customers of other smaller NBFCs

Due to its early mover advantage, Northern Arc had early relationships with every worthy Fintech NBFC in the country including the large ones like Navi Finserve, Krazybee, Early Salary, Moneyview, etc. During the stage 1 of the relationship, Northern Arc would either directly lend money or arrange debt capital for these Fintechs. As the relationship matured with many of them, Norther Arc has moved to stage 2 of the relationship.

Opportunity: Fintech NBFCs have spent a lot of time & resources in acquiring a customer via digital channel (google, online aggregators, e-commerce, modern retail). A lot of them have now started getting good volumes of business. While this is good news for Fintech NBFCs, they still have to grapple with one problem – the regulator, rating agencies, and bond markets hold a “high risk” perception of these Fintech NBFCs and will not allow them to lever beyond 3x (if their net worth is 100cr, they can only have on-balance sheet loans up to 300cr).

It is not possible to raise equity capital all the time. Hence many of these Fintech NBFCs are forced to partner with other large NBFCs or partner with mainstream NBFC like Northern Arc to channelized the excess volume of business.

Business model: When a customer is applying for a loan through Fintech App or any other web- based channel, the Fintech NBFC gets all the customer data and documents. In real-time, they are shared with Northern Arc too. Based on its own internal credit engine, Northern Arc decides within minutes if it wants to lend to that customer or not. If yes, the loan sits on the balance sheet of Norther Arc.

- Advantage for Fintech:Even if there is limited room on its own balance sheet, the fintech can service the customer through its partner NBFC. This keeps balance sheet light while it still earns sourcing servicing fee

- Advantages for Northern Arc:It can select the customer profile that is within its comfort zone, it does not have to worry about directly servicing the end customer, and credit risk is covered with FLDG as per the RBI regulation.

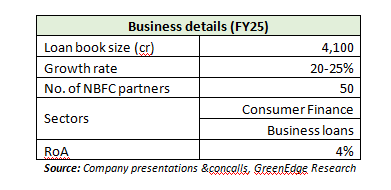

Economics & future growth: Northern Arc does this business with ~50 Fintech NBFCs (most of them have been customers for Business 1 for many years). This is not only a fast growth business but also has better profitability. The ability to earn better profits stem from the its tech capabilities, which allow Northern Arc’s systems to seamlessly integrate with systems of Fintechs/NBFCs and arrive at instantaneous decisions.

Business 3 – Direct lending to customers

Direct lending to customers requires a lot of infrastructure – branches, employees, loan processing & servicing capabilities, sourcing & collection teams, etc. Northern Arc took this plunge in 2021 by entering the microfinance and MSME (small LAP).

- Microfinance: IThis business was started by acquiring SMILE microfinance. Branch count increasedto 287 and current loan book stands at ~1,100cr. Along with the sector, this business is under pain and is expected to bottom out by Sep’25

- MSME (small LAP): This business involves providing secured business loans in the 10-12lac ticket size at an interest rate of 17-20%. The Company also has a small book of Supply Chain Finance and Mid-Marketlending. Current AUM stands at ~1,900cr and is conducted via 69 branches across seven states. This business is doing fine, but is still in its infancy stage

While direct retail lending is not an easy business, it has the biggest potential and the highest reward, if successful. For Northern Arc, this business is in its infancy phase and going through its first down cycle. We are not getting into economics of this business as it is too early to arrive at any steady-state numbers. It would be safe to assume that profitability of this business would currently be a fraction of the other two businesses.But the stable cashflow from the other two businesses gives Northern Arc a long rope to fortify this business.

Northern Arc – An investor’s perspective

For investors wanting to invest in the NBFC space, either for a structural reason or for playing the cyclical revival, Northern Arc presents an interesting choice. This is one NBFC which can give an exposure to 100s of other NBFCs as well as to direct retail lending business. Business cycle for NBFCs is turning favorable and Northern Arc is available at cheap valuation. Let us analyze what can go right or wrong for the investor.

Past 12 months have been volatile

The stock has been under pressure since its IPO listing due to various reasons – general correction in

markets, pain in microfinance personal loans, specific news flow on problems in one of its large

accounts i.e. Aviom Housing, and exits by private equity investors.

What is the market trying to signal?

At CMP of INR255, the stock still trades at ~1.15x on delivered book of FY25. When a stock trades

close to its book value, the market is usually thinking the following – either there is more pain to

come in terms of asset quality or regulations; or there is little confidence in future growth &

profitability; or there is general lack of interest / misunderstanding about the business model.

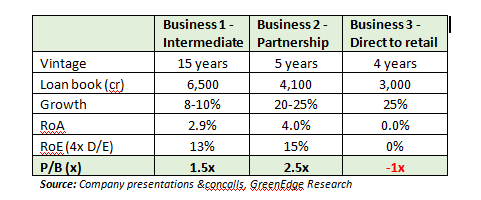

Above is an attempt to apply sum-of-parts methodology on Northern Arc. Business 1 and Business 2 were stable & growing businesses even during the tough year of FY25. Based on its long-term growth & RoE profile, we have assigned 1.5x and 2.5x multiple to them respectively (we note that MAS Financial trades at 2.2x despite a less diversified B2B business & no tech-based platforms). With the above assumptions, we realize that the stock market is currently giving negative value to Northern Arc’s direct-to-retail business!

Our understanding is that this valuation apathy is probably due a combination of both – fear that pain in MFI & personal loans may not be over; and there could be general lack of understanding among the market participants w.r.t to Business 1 and Business 2 (History has shown that credit losses faced by Northern Arc has always been much lower than that faced by its NBFC clients, but markets are yet to appreciate this).

What can result in re-rating of Northern Arc?

The macros are getting favorable – regulatory tightening cycle is over; interest rates have started to

come down; and stress in personal loans & microfinance have started to bottom out. It’s a matter of

quarter or two that the sentiment around these segments should start improving. If the same is also

applicable for Northern Arc’s loan portfolio, credit costs in FY26 should be lower than that in FY25

and that could lead to stronger earnings growth.

Another important driver of re-rating would be Northern Arc’s efforts to fortify and grow its direct- to-retail business. Currently, market is assigning zero-to-negative value to this business. Well established direct-to-retail NBFC businesses trade at valuations of 2x-4x on book.

What are the key risks?

The management has guided for some softness in microfinance portfolio for Q1 and Q2. If the

weakness continues beyond that, investors will continue to remain averse to all MFI companies

including Northern Arc. Any adverse ruling in case of its Aviom exposure could also reduce the

investor excitement for B2B business.

Another risk for the partnership business stems for evolving regulatory guidelines. But over the years, this risk seems to be reducing as can be seen from recent RBI moves (allowing FLDG for digital lending, ensuring data sharing in on-lending & partnership lending).

Disclaimer:GreenEdge Wealth Services LLP is SEBI registered investment advisor. However, the above article has been written for educational purpose and should not be construed as an investment advice. As a part of our advisory activities, we may have recommended equity and debt instruments of some of the companies discussed in this article to our clients as well as for our personal investment portfolios. The readers are requested to do their own due diligence.