What Pamela Anderson Teaches Us About Investments?

You may be bewildered, shocked or plain amused on reading the title! How on earth, can the buxom Baywatch babe be even remotely linked to the world of investments? Well, after all, there is an uncanny link between the two.

Pamela Anderson – Journey From Becoming Millionaire to going Broke

The voluptuous actress, showgirl and model starred in 110 episodes of Baywatch earning $60,000 per episode in late 1990s. This implies an enviable income of 110*60,000 = $6.6mn. (We have not accounted for the $3,00,000 she earned per episode at the peak of the show’s run.)

By any stretch of imagination, it would be difficult to guess that an individual earning a mind-boggling $6.6mn in a span of 5 years, can go broke. But, that’s precisely what happened!

Financial Turbulence Hits Pamela – Unpaid Taxes & Piling Debt

-

Back in 2009, she owed $1.7 mn in taxes. Her name also appeared in Top 500 Delinquent Taxpayers list. In 2012, she still owed $ 137 thousand in taxes.

-

In 2013, she was forced to sell her uber luxurious Malibu home to repay her debt partially. She was also sued by construction companies for unpaid bills. She was reportedly getting gold and platinum tiling done at her Malibu home as a part of renovations.

3 Key Financial Lessons from Pamela Anderson’s Story

-

Don’t live beyond your means

-

Have an investment plan

-

Start investing early

Now we will dwell a little on the above 3 Financial Lessons.

- Don’t Live Beyond your Means – Avoid Debt Traps

From Pamela Anderson’s story, it is absolutely clear that her diva-like lifestyle which she couldn’t afford was the cause of her financial undoing. It is very natural for each one of us to desire a good lifestyle – owning latest gadgets, aspirational brands, swanky cars, beautiful homes and craving exotic foreign holidays to name a few. Also, peer pressure can prove to be fatal in this case.

But it is very critical to ensure that these lifestyle aspirations are not met through injudicious use of credit card debt, personal loans which could lead to a debt trap. Ideally, these lifestyle expenses should to be planned after setting aside some savings and keeping one’s income in mind.

- Have an Investment Plan – Invest in Equities for Growth

On reading Pamela Anderson’s story it doesn’t look like she had an investment and savings plan. You may have some milestones in life like purchasing home, car, foreign holidays, kids’ education, kids’s marriage, philanthropy, retirement, etc. Each of these goals in life will entail some money outflow at a future date for which you need to invest today.

Investing only in the conventional FDs, Gold and Real Estate may not fetch you inflation-beating returns. Investing in stocks can lead to superior returns and provide an opportunity to participate in India’s growth story and invest in different businesses. Click to read – Why Should You Invest in Stocks?

In the above chart, it is assumed that Rs. 20,000 is invested every month for 10 years in Savings Account (4% returns), FD (8% returns), Real Estate (12% returns), Equity (15% returns) which results in Rs. 29 lacs, Rs. 37 lacs, Rs. 46 lacs and Rs. 55 lacs respectively.

Clearly, investing in equities can be more rewarding than other asset classes while investing directly in quality stocks have the potential to deliver far better returns than 15% assumed for equities above.

- Start Investing Early – Ride the Magic of Compounding

It’s not without a strong reason that Albert Einstein has said,

“Compound interest the 8th wonder of the world.

He who understands it, earns it;

He who doesn’t, pays it”

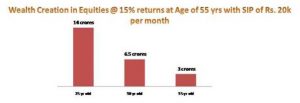

A simple 10 sec glance at the below chart will highlight the importance of starting investing early.

It is assumed that three individuals aged 25 yrs, 30 yrs and 35 yrs start investing Rs. 20,000 per month in equities compounding at 15% until they all turn 55 years old. The difference in the wealth created for each individual is staggering – Since the 25 yr old guy started investing early, his money compounded for 30 years while the 35 yr old guy’s wealth compounded for 20 years and this created a difference of Rs. 14 crores minus Rs. 3 crores = ~Rs. 11 crores! Ergo, longer periods of staying invested will be more rewarding thanks to compounding.

Pamela Anderson’s story and above illustrations clearly highlight that not living within ones means and not starting investing early is a huge opportunity cost which can haunt you. And yeah, as seen from the last chart, it is possible to become a crorepati with patient and periodical investment.