The rally in PSU Banks that started with SBI in 2021, was strengthened by BoB & Canara & Union Bank in 2022, and then furthered by long tail of PNB, Bank of India, IDBI, UCO, Central Bank and IOB in 2023. While the rally in most cases has been backed by improving earnings delivery, there is an ancient investing rule that subtly reminds us “when the strongest rally is witnessed in the weakest pockets of the sector, it is time to re-assess the merit of the rally and its future prospects”

Analyzing the long-term case for investing in PSU Banks Let us analyze if the four key reasons that were responsible for the strong rally in PSU Banks are equally valid today or they have become stronger or weaker:

1. Reduced government interference: The bad lending practices that prevailed over 2009-14 were responsible for the NPA crisis of 2016-21. Reforms like PCA, IBC, merging weak Banks with strong ones, and inducting private sector talent were initiated. To us, the biggest reform seems to be the reduced government interference in lending and increased government oversight into systems, processes & people. That more or less continues till date.

2. Strong credit cycle: Indian Banking system has witnessed good credit growth and asset quality performance over FY22 & FY23. The good asset quality performance may extend well into FY24 & FY25 because indicators like corporate balance sheets, household savings, urban & rural

wages and real estate prices are strong. However, we may have already made a high base for growth and only those PSU Banks with capabilities in retail & SME may deliver double digit growth.

3. Building capabilities: Prior to 2018, most PSU Banks did not have capabilities to do retail lending or earn fee income that is not related to lending. Lately, we have seen that BoB, Indian Bank and Union Bank have taken initiatives to improve their retail capabilities. We have also seen that

tech solutions are increasingly being used to service the customers (Yono SBI). However, challenges around talent gap in the PSU banking sector remains high and success if any will be very slow.

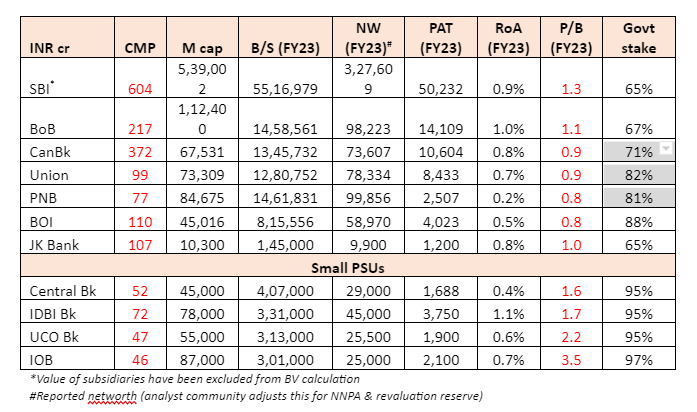

4. Attractive valuations: In early 2021, we were at a juncture where most PSU Banks were trading at 0.4-0.8x book and growth & profitability (avg RoA = 0.4%) was about to improve. Two years later, growth and profitability both have improved (avg RoA = 0.8%), but so have the valuations

at 0.8x-3.0x book (table below). Thus, re-rating can no longer be a big lever and only those PSU Banks will re-rate who can demonstrate decent growth.

As we have seen from the above arguments, that the case for secular rally in all PSU Banks today is not as strong as it was in 2021. Hence, it’s time to adopt a stock specific approach. Based on the business strength, we classify the PSU Banks in to four categories:

Category 1 = SBI, BoB

- These are the most well-run PSU Banks and have some capabilities in retail & SME lending

- Credit costs are at their lows of 0.3-0.4% and RoAs are close to highs of 0.9-1.0%

- RoA improvement if any will be modest and may not sustain

- Valuations re-rating will be slow, that too if RoAs remain at these decent levels for FY24 & FY25

- Stock returns should be in-line book value growth or RoEs (Estimate for FY24 & FY25 = 15%)

Category 2 – Canara, Union

- They don’t have retail/SME capabilities of SBI or BoB, but they are better managed than others

- Credit costs for FY23 were around 0.8-1.2%, so there is scope for improvement in FY24 & FY25

- RoAs will touch 1%+ in FY24 & FY25, but eventually, it may revert to 0.8%

- Stock returns can be decent since there is re-rating potential in addition to book value

compounding

Category 3 – PNB, BOI

- These are large PSU Banks, but rank one notch below Canara & Union in terms of capabilities.

- Credit costs for FY23 were around 1.2%, so big scope for improvement in FY24 & FY25

- RoAs will touch 0.6-0.9% in FY24/FY25, but eventually, it may revert to 0.7%

- Stocks have already run-up, re-rating potential is limited

Category 4 – Smaller PSU Banks

- They rank lowest in terms of business capabilities (CASA ratio, fee income profile, retail lending)

- Currently, they are reporting RoAs of 1%+, but once the NPA recoveries are over, RoAs will

revert to lower levels of 0.6% - Hence, they should not be trading above book value. But since the free float is very low (govt

holds more than 90%) and there is buzz about privatization, there is irrational exuberance here. - Valuations re-rating will be slow, that too if RoAs remain at these decent levels for FY24 & FY25

- Unless privatization plays out, investors in this category can see good amount of pull-back.

Currently, the issues that are worrying the investors in PSU Banks are the problem of peak NIM and the impact of IND-AS migration. We believe that NIMs will stabilize in the next two quarters and till then, the improvement in credit costs will help in sustaining the profits. The worry on IND-AS migration is a little too early in the day, since by FY26, the ECL model will have data related to 3 good years i.e. FY23, FY24, FY25 and this may result in a much lower provisioning number.

Many investors still believe that the entire PSU Banking pack can re-rate further by 10-20% (that fair valuation for SBI can expand from 1.3x to 1.5x; and that will commensurately push up valuations for all other PSU Banks). However, we don’t want to base our investment thesis on sector level macro

assumption, since our micro analysis suggests that the only a few PSU Banks have the room for growth & asset quality surprise.

Disclaimer: We are SEBI registered investment advisors and Research analysts and would have recommended some of the stocks or bonds to our clients. The above views reflect our independent judgement at current point in time and should not be construed as investment advice.