For any form of asset-backed financing, the trend in underlying asset prices serves either as tailwind or headwind. When the asset prices are strong, the financier enjoys good growth, operating leverage and negligible NPAs. When the asset prices decline, the reverse is true. The property price boom of 2006-16 benefited the housing finance companies, the gold price boom of 2018-20 benefited the gold loan companies and the truck price boom of 2020-23 benefited the vehicle finance companies.

The previous two gold cycles

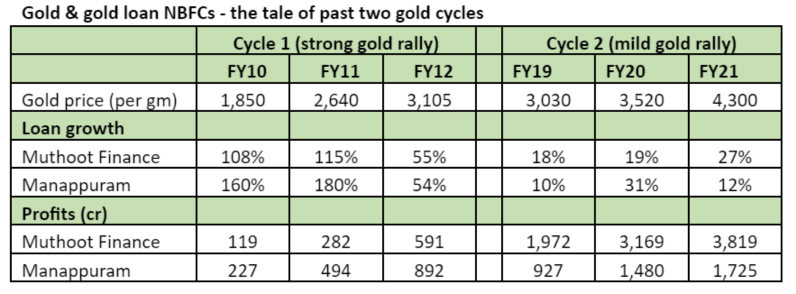

With gold prices hitting all-time highs, it is natural to ponder over the possible benefits that can be accrued by the gold loan NBFCs. An analysis of gold upcycles of 2009-12 and 2018-20 clearly demonstrates that the business performance of these NBFCs have +ve correlation with gold prices.

In the above table, one must note that during Cycle 1, the RBI regulations were in formative stages, competition was strong, and the gold price rally was strong. During the Cycle 2, the RBI regulations had fully evolved, competition was benign, and the gold price rally was moderate. In both the instances, gold loan NBFCs managed to do well. Now that we are at the beginning of “Cycle 3”, it may be helpful to analyze if the historical insights are still relevant and is it rational to expect an encore?

The set-up after "Cycle 2"

The "Cycle 2" ended in August 2020, with gold prices touching INR5,650 per gram. In those pandemic days, gold loans seemed like the safest product and many banks, NBFCs and Fintechs jumped into this bandwagon. The industry expanded over 2021-23, but intense competition dented profitability for everyone including the incumbent gold loan NBFCs like Muthoot & Manappuram.

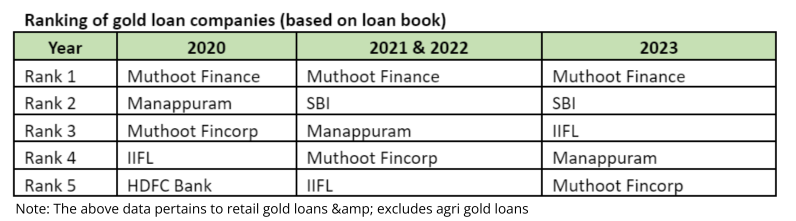

SBI, IIFL and Rupeek were the poster boys of this phase. From virtually being absent in the retail gold loan space in 2018, SBI is now the 2nd largest retail gold loan provider in the country. IIFL increased its branch count by 2.5x and gold AUM by an even higher number. Amongst the incumbents, Manappuram suffered the most with its loan book rank dropping from No.2 to No.4 (table below)

The start of "Cycle 3"

The “Cycle 3” for gold prices seems to have started somewhere in Jan’24, with gold prices decisively crossing the INR5,650 levels. More recently, gold has made life time highs even in US$ terms. Just when the new cycle is about to start, we witnessed regulatory actions from RBI:

- IIFL Finance: RBI found some process related deficiencies in the gold loan business and has directed them to stop disbursing new loans. This is a very stringent action from RBI and IIFL surely has an uphill battle even after the embargo is lifted.

- SBI & PSU Banks: RBI found many instances of LTV violations in the gold loans disbursed by PSU Banks including SBI and has directed them to go slow on gold loans until they are able to improve their gold assessment skills

This brings us to a set-up where the gold prices are firming up, the demand for gold loans is likely to go up, and the No.2 & No.3 player are temporarily out of picture. This puts the incumbents in a sweet spot and given their decades of experience & process expertise, it is unlikely that they would have such observations from RBI.

Possible beneficiaries in "Cycle 3"

Muthoot Finance is India’s largest and the most well managed gold loan NBFC. The biggest strength of the company is its highest “per branch AUM” of INR15cr, which makes it the “lowest cost” player. Although it could grow and defend its market share during the intensely competitive phase of 2021-23, the yield on its gold loan portfolio declined from highs of 21% to lows of 17%.

Given the benign gold prices and competitive environment, it is possible for the company to enjoy good growth, improving margins and operating leverage. At CMP of 1,330, stock trades at 2.2x on FY24 book, which is at 20% discount to historical averages. The risk reward for an incoming investor seems favorable.

Manappuaram is now India’s 4th largest gold loan provider and has a sizable branch network. While it can also benefit from the impending boom, its gold loan business suffers from high-cost structure (per branch AUM of INR6cr). Also, it has a sizable non-gold business, where the cycle is turning adverse. Nonetheless, the promoters have sizable experience in gold loan space and positive in gold can have a positive rub-off effect.

Muthoot Fincorp (unlisted) is the 5th largest gold loan provider and also stands to benefit from the upcoming boom in gold prices. While they also have high cost structure (AUM of 5.5cr per branch), they have significantly revamped their sales & branch operations and seem to be ready for growth.

Gold prices – a favorable set-up in making

Gold has dominated the wealth, trade & currency aspect of humanity for over 4500 years. It is only in the last 50 years that there have been some serious & successful attempts at replacing gold with US$. However, the events of past 4 years have reduced the confidence in US$ as the world’s reserve currency. Inflation is back with a bang and the reckless borrowing & spending by US & Europe have frightened the rest of the world. Many countries are slowly & stealthily trying to reduce its dependency on US$ (China, Russia, India, Iran, Qatar to name a few)

The world may not move back to gold like the pre-Bretton-Wood days but gold can surely play an important role in the ensuring smooth transition from a US$ dominated economy to a multi-currency economy. The technical set-up is becoming stronger by the day, with gold making new life time highs in all major currencies.

Wise people have always highlighted the futility of predicting prices, especially in case of commodities. But none of them have said that its futile to analyze the demand-supply trends! Hence, we stick to just that i.e. analyzing the demand supply for gold and we leave the price predictions to the reader. Details can be read in our November 2023 note (https://greenedgewealth.com/gold-time-to-rise-shine/)

Note: The data used above has been taken from company presentations or annual reports. Greenedge Wealth is SEBI registered investment advisors. However, the above article should be not be treated as an investment advice. The readers are requested to do their own due diligence.