Humanity’s fascination with silver is as old as that for gold i.e. 4,500 years and it has also been assigned the status of “distant cousin of gold”. Over the past six months, the outlook for gold has substantially improved and gold prices made new life time highs in all major global currency terms (Our Nov’23 note on gold https://greenedgewealth.com/gold-time-to-rise-shine/). The obvious question for an investor would be that if gold has started doing well, can silver be far behind?

Gold v/s Silver – the similarities & differences

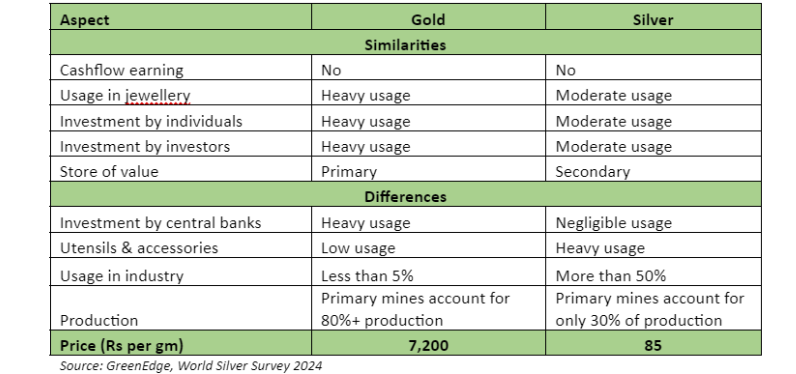

Before we get into an in-depth analysis on silver, let’s list down the similarities & differences between the two most popular of the precious metals. From an investor’s perspective, the two most notable differences are:

- Industrial demand isn’t important for gold but very important for silver.

- Central bank demand is very important for gold, but not for silver.

The gold-to-silver ratio

Hundreds of years ago, the Roman emperor had fixed this ratio at 12:1, implying that it would take 12gms of silver to buy 1gm of gold. Over the future centuries, mining technology evolved and this ratio has kept on changing. Over the last 50 years, below is it history:

- Highest (2020) = 125:1.

- Lowest (2010) = 25:1.

- Average (1980-2024) = 48:1

- Current (2024) = 84:1

Based on the current prices of gold and silver, it requires 84gms of silver to buy 1gm of gold. If this ratio has to return to 50-yr historical average, silver price needs to appreciate by ~75%. We are currently in an environment where gold prices are expected to remain strong or appreciate further. If both these situations play out, silver bulls are arguing that it is possible for silver to rally by 75%+.

Silver – analysis of demand scenario

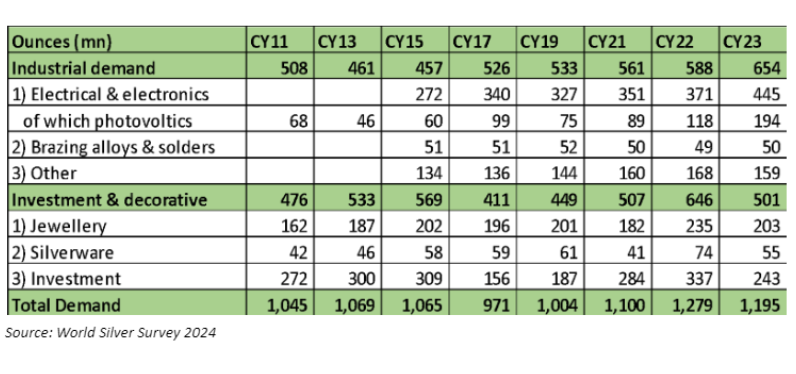

Industrial demand, the largest source of demand for silver, remained muted over 2011-19 due to general slowness in manufacturing & capex activity across the globe. With sharp revival in industrial activity, especially on the electronics & solar cell manufacturing front, the industrial demand has seen strong growth over 2021-23. As the rate of solar adoption increases across the globe, one can expect a positive growth in the industrial demand for silver up to 2030.

The demand from investment & decorative activity has been rather stagnant over the past 13 years. While some portion of this demand is steady consumer demand, some portion is also linked to silver prices and trading activity of individuals. Since the silver prices have been subdued since 2010, the investor demand has been rather lackluster.

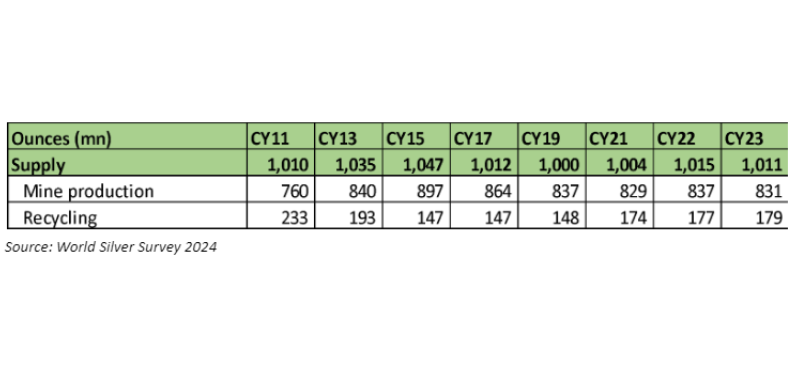

Silver – analysis of supply scenario

Global silver production has been stagnant for over 13 years now. The global mines have not been able to keep pace with the recent rising demand from the industry. Some of the reasons for this are:

- Politically sensitive countries like Mexico, Peru, Chile, Bolivia and Argentina account for 50% of silver mining. There have been some or other disturbances in these countries.

- 70% of silver is produced as by-product from mining activity for base metals like copper, zinc, lead, etc. Due to suppressed demand environment, base metal mining activity itself was subdued.

- Since silver demand & silver prices both were subdued over 2011-19, there was no incentive for miners to invest more in new mines.

As per global mining companies like Fresnillio, KGHM and Glencore, silver production will remain stagnant in 2024 as well. But some improvement can be expected from 2025 as investments done by countries like Canada, Peru, Russia and US come on-stream.

Imbalance & price action

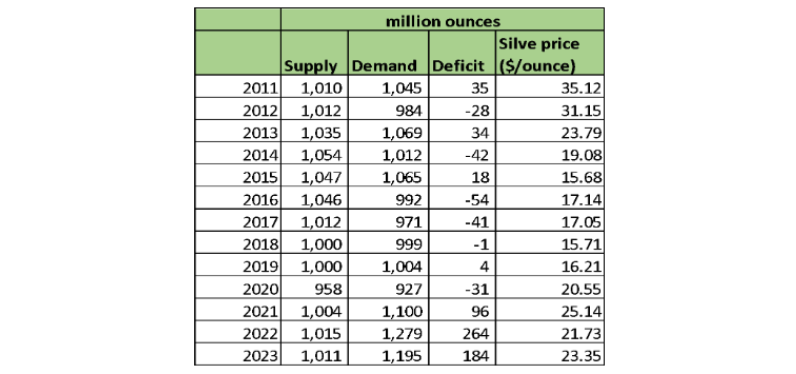

We have all learnt that price of a metal is determined by demand & supply scenario. Over 2010-20, demand was weak, silver production was in excess of silver consumption and hence the price action was muted. Over 2021, 2022 and 2023, the demand recovered sharply, especially on the industrial side and there was large deficit in each of these three years. The cumulative deficit was enough to wipe out the surpluses of the entire decade twice over.

Yet, the price action has remained subdued and the current price of $27.41 is still 45% away from the 2010 levels of $40.41! One the big reason is that there are high levels of over ground inventory in vaults of London & China and liquidation of that is keeping the market well supplied. As end of Dec’23, the inventory levels have declined from ~22 months of supply to ~12 months of supply.

In absence of tightness in physical market, the silver prices are determined by institutional investors, who have had a general apathy for precious metals since 2013. But very recently, we have seen that gold has spiked, thanks to the central bank buying. If history is any indicator of things to come, a rally in silver cannot be too far.

Should you invest in silver?

Demand side seems decent – Industrial demand seems to be robust, especially with pick-up in global industrial activity and energy transition (solar). The investment demand is currently muted, but that can change if there is positive price action.

Supply side is expected to remain muted – new mines will come on-stream only in late 2025. The over the ground inventory levels have already reduced from high of 22 months in Dec’20 to 13 months as on Dec’23.

Gold-to-silver ratio is at the peak & Gold price is one the move – thanks to geo-politics, de-dollarization and unsustainable debt levels of various western economies including the US, gold prices have rallied to all time highs. Any further increase in gold price or mean reversion in the gold-to-silver ratio can propel a rally in silver.

The back-drop is such that a slight bit of positive news or event can propel silver to higher levels. Price action will re-ignite the interest of institutional investors, who are now busy in equities, bitcoin or gold. It makes a lot of sense to own silver in the portfolio (in addition to gold), not only from the point of view of diversification, but also for decent returns.