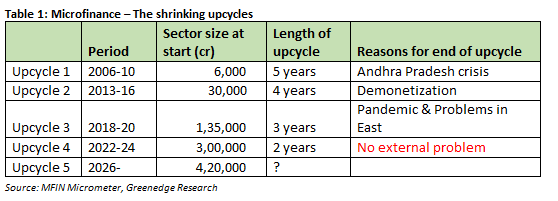

Over the past 20 years, the microfinance sector has witnessed four upcycles & downcycles. There has been amazing predictability in the sector i.e. every downcycle has been succeeded by at a strong upcycle, where profits would become 2-3x of the previous peak and so would the stock prices. Given that the sector has already passed through 15 months of downcycle, is it time to think about the next upcycle? Before we answer that, let us do a quick re-cap of the past cycles:

It is easy to observe the inverse correlation between the size of the sector and the length of the upcycle – in the early years, the sector was small & underpenetrated and hence the upcycles lasted longer. Another important point to note is that in the earlier three upcycles, there was strong external force that ended the cycle. In case of the current upcycle, there was no major external problem and yet the upcycle ended badly.

Four most dangerous words The microfinance players were in complete denial until as late as Jun’24 and even the respected players continued to guide for 20%+ growth. Now that we have the benefit of witnessing four quarters of the current downcycle, we surely know that the sector has collapsed under its own weight – borrower overleverage, employee attrition, and process indiscipline have been bigger reasons for the fall in comparison to external reasons like elections, political intervention, floods, etc.

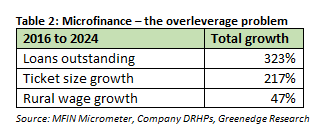

Borrower over-indebtedness is the biggest problem i.e. an average borrower has borrowed too much in comparison to his income & wealth. We had highlighted this issue in 2020 as well and it has become only bigger since then. Given that this problem was built over a decade, the solutions will also take its own sweet time.

In a rare instance of regulatory outburst, the RBI recently asked the microfinance sector to do some soul searching and go in for urgent reforms. All this has tempted to use the four words that are considered as most dangerous in the field of investing – “this time is different”! The down phase of this cycle may end in a quarter or two, but there are no signs of a possible upcycle in the sector.

Brahma, Vishnu, and Mahesh – time for creative destruction

In the context of the microfinance sector, the RBI and the Government has played the role of Brahma (creator) and Vishnu (preserver) over the past 13 years – After near death experience during the Andhra crisis of 2010, the microfinance sector got a fresh lease of life after the RBI give legal recognition & protection to the sector. This combined with government’s affinity for small rural loans ensured priority status for this sector and ensured uninterrupted flow of debt capital from banks & equity capital from investors. The sector grew 20x in size from INR 0.22tn in 2010 to INR4.4tn in 2024. Then came the fourth down cycle and the regulators tone has been different this time.

It is clearly in no mood to give additional concessions to the sector. In fact, it is quite clear that the “creator” is disappointed by the indiscipline of its “creation”, and it is the time for Shiva (destroyer) to play his role. Below are some changes that are expected in the sector:

1.Re-defining the basics: At the core of microfinance was the JLG model, where a large group of women would borrow & repay the loan. The implicit group guarantee ensured low operating costs for the lenders, as they were spared of the effort of individual level credit appraisal or collections. This model worked brilliantly in the initial years, but as ticket sizes increased, the group dynamics had started developing cracks over the past 5-7 years (low attendance, low affinity to chip-in for others non-payment). This reached its zenith in FY25.

Any serious player will have to pivot towards individual lending i.e. developing capabilities to do credit appraisal & collections at an individual level. That will require sizable investments in employees and skill-sets.

2.Building expertise beyond microfinance: For an NBFC-MFI, the regulator has increased the upper limit for non-MFI portfolio from 25% of total loans to 40%. This is a clear nudge by the regulator to build expertise in other lending products. For most MFIs, building this expertise will entail years of investments and learnings

3.Slower growth & lower profitability: All the above means that the sector will report lower growth of 10-15% for next eighteen months (v/s 20-25% in the past). Also, the profitability will be meaningfully lower due to investments that will have to be made in developing new skills.

Which “Microfinance heavy” banks are well placed?

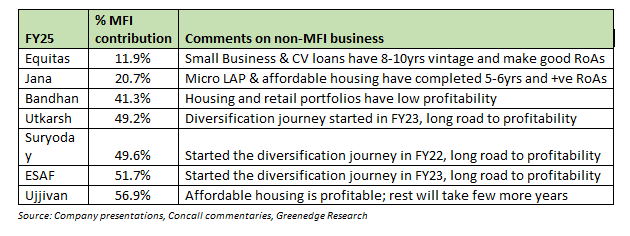

Prior to their conversion to small finance banks, most of them were heavily dependent on microfinance (MFI). Post conversion, they started their diversification journey towards “secured products” by introducing products like micro-LAP, small business loans, used CV loans, gold loans, affordable housing, and SME financing. Equitas and Jana Small Bank lead the pack on diversification, while players like Utkarsh, ESAF and Suryoday have just about started this journey. Ujjivan still remains heavy on microfinance due to its inability to scale the MSME business in the past.

The next 2-3 years will be all about consolidating the MFI business and accelerating the non-MFI business. This will have implications on profitability and growth since MFI is the highest yielding business and non-MFI businesses involve heavy initial investments in sourcing, servicing, and collections.

It seems that MFI heavy banks like Bandhan, Utkarsh, Suryoday, ESAF and Ujjivan will continue to face the twin problem of declining incomes and rising operating costs. As a result, their earnings trajectory will remain subdued in FY26 as well. Ujjivan could be an exception to this due to its best-in-class performance in the microfinance space. At the other end of the spectrum, Equitas and Jana Small Bank have already taken these hits on income & operating costs over the past 5-7 years and they will soon be able to report better numbers in FY26 and FY27.

What about “Microfinance heavy” NBFCs?

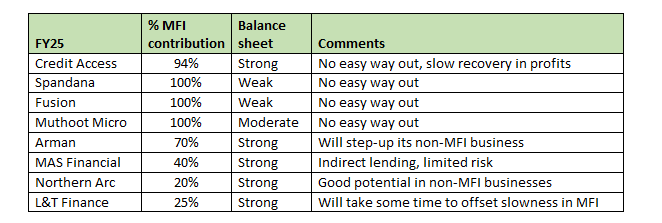

Pure play NBFC-MFIs like Credit Access, Spandana, Fusion, and Muthoot Microfin bore the maximum brunt of the current downcycle. While losses for them will subside in FY26, some of these balance sheets have weakened and will require fund infusion (at current depressed valuations). They also have an uphill task of diversifying away from microfinance.

On the other hand, NBFCs like Arman, Northern Arc and L&T Finance have strong balance sheets and lower dependence on microfinance. They will be able to grow in other high-yield lending areas like retail loans and small business loans and improve their earnings profile.

Appendix: The good, bad, and ugly of FY25

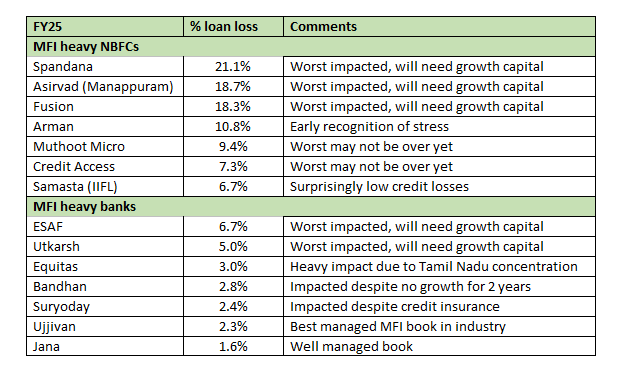

Below are the credit losses (as % of average loan portfolio) suffered by various players engaged in microfinance business for FY25. The current downcycle is still not over and we could see more losses over the next two quarters of the current financial year (should be lower than FY25 levels).

We have not included L&T Finance, Belstar (Muthoot Finance), and Northern Arc in the table since their segmental credit costs are not available in the public domain. Also, the numbers for banks are on the overall portfolio, so the actual percentage losses in microfinance division would be 1.5-2.5x of these numbers.

Disclaimer:GreenEdge Wealth Services LLP is SEBI registered investment advisor. However, the above article has been written for educational purpose and should never be construed as an investment advice. As a part of our advisory activities, we would have recommended equity and debt instruments of some of the companies discussed in this article to our clients as well as for our personal investment portfolios. The readers are requested to do their own due diligence.