The history of stock markets is replete with wealth creation stories that involve "improved capital allocation". We have seen that with ITC, when it stopped investing in non-related businesses & improved dividend payouts; Usha Martin, when is sold the loss-making steel plant to Tata Steel, Heritage Foods, after it sold the loss-making retail venture. The events that have unfolded at JM Financial over the past 5 months suggest that it could well be at the cusp of such transformation.

Most of us know of JM Financial as a capital market player and looking at the profits & stock price performance of past 6 years can make anyone wonder as to "why did they not benefit from the booming stock markets?"

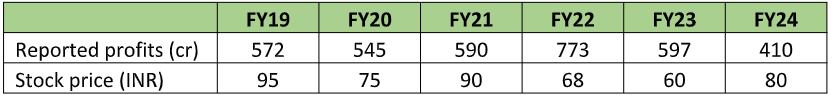

Table 1 - Stagnant profit & stock price performance of JM

Surely, JM is one of leading player in capital markets. In fact, it is as old as India’s capital markets itself and is credited to have introduced India’s first fully convertible debenture, the first equity warrants & deep discount bonds, the first 100cr IPO and the first billion-dollar IPO. But between 2012 & 2016, it had bet heavily on balance-sheet based businesses like wholesale lending, affordable housing finance and asset reconstruction company (ARC). So much that ~60% of company’s resources were dedicated to them.

Over the past 6 years, these balance sheet heavy businesses suffered from tough macros, regulation and sheer bad luck as well. Not only did these businesses off-set the upside from capital market linked businesses, but they also suppressed the firm level RoCE and RoEs.

Section 1: What caught our attention?

Despite this rough patch, we continued to track JM for the simple reason that through all these six years, they have maintained leadership in their core business i.e. Investment Banking, Institutional Broking and Corporate advisory; seeded new businesses like AMC & Wealth Management and increased investments in retail broking & distribution (platform AWS).

To us, it always seemed that the valuation of JM’s capital market businesses has been suppressed due to turbulence in balance sheet-based businesses. The much-awaited inflection point came in May’24 when the management announced their quarterly results. The press release & investor call had two strategic announcements:

- First – intention of run down the wholesale lending and ARC business (rather convert the balance sheet heavy business into balance sheet light syndication business)

- Second – the cash that thus gets released, will be partly used for distribution to shareholders and partly into syndication / AIF business

Another positive was that in less than 3 months since this announcement, JM has not only simplified the corporate structure (bought-out a large JV partner) but also gave a tentative schedule of the run down for the mortgage & ARC businesses. At such a juncture, it may serve us well to take a deep dive into JM’s problems, their strength, the resolution to the problems and the future possibilities.

Section 2: The past six years – problems visible, progress invisible!

For a business as diverse as JM Financial, it becomes essential to look at individual business components to understand the reasons for underperformance. Given that segmental reporting was changed in FY21 and there could be confusion, we have tried to come up with our own business classification, where there are 3 main businesses (instead of the 4 reported in the company PPT):

Capital Markets: These are mostly fee-based businesses and do not require a lot of capital. Primary activities include Investment Banking, Institutional Broking, M&A advisory, retail broking & distribution, related financing, wealth management and AMC. An important thing to note here is that if these businesses have to operate at scale, they will definitely need some amount of balance- sheet support (margin needs, LAS, promoter funding, under-writing, etc). In the context of current reporting, retail broking & distribution, related lending and AMC comes under the “platform AWS” division while the remaining businesses fall under the “IB” division.

Mortgage: There are two components to this business i.e. wholesale mortgages (builder loans, land financing, large LAP) & retail mortgages (home loans, small LAP, loans to education institutions). This is a purely balance sheet driven business.

Distressed Credit (ARC): This business involved buying the problematic loans from banks, turning them around and earning a profit in process.

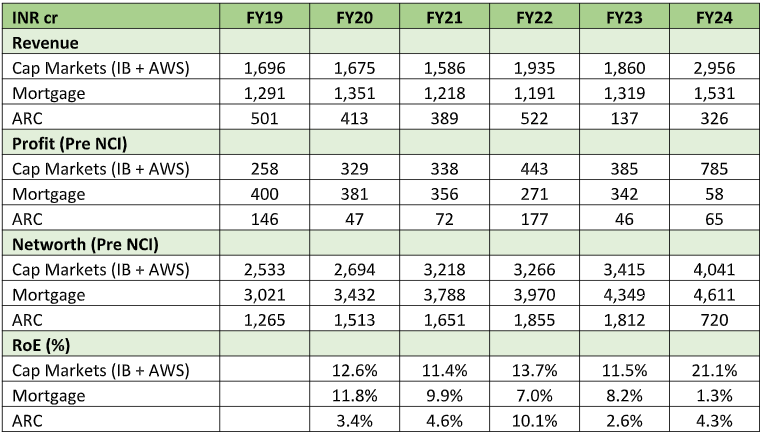

Table 2 – Business activity wise profits & return ratios (RoE)

The strength & success of a business can be judged by the long-term return ratios generated (RoE). A quick look at above table gives us the following insights:

- Insight 1: JM invested a lot of capital in Mortgage & ARC businesses (60% of total), but they could not generate good RoEs due to multiple reasons – adverse macro post IL&FS and COVID, tightening regulations and some bit of bad luck.

- Insight 2: JM's capital market business generated double digit RoEs even during the tough years of FY21-23 and made a smart recovery in FY24. Clearly, the decent performance of this business is over-shadowed by the weak performance of other two businesses.

Section 3: Thinking about future possibilities – Growth, RoE or both?

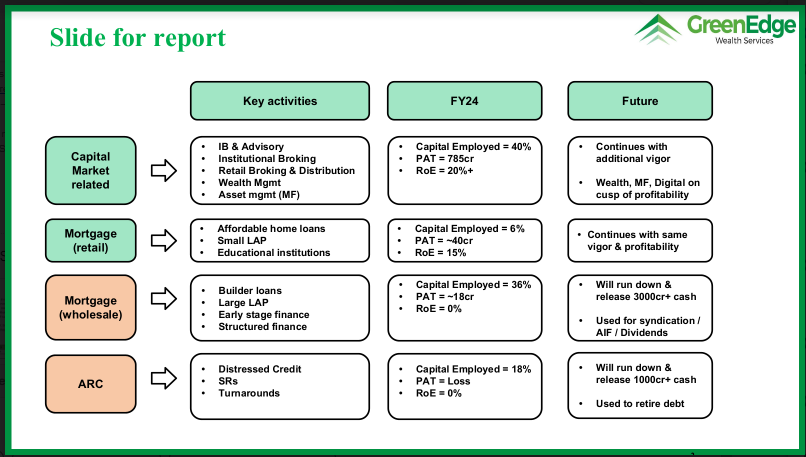

To understand how growth can sustain and RoEs can improve, let’s try to bucket the business into three parts (chart below) – businesses that will continue, businesses that will run down, and new business that will be created.

A. Businesses that will continue

- Capital Market related businesses: This is JM’s crown jewel, responsible for good growth and RoEs. While its leadership in IB & IE will likely continue, its wealth, MF & digital broking businesses are expected to turnaround in next 2 years. Thus, whenever we have the next capital market peak, this business division can deliver profits that are much higher than the 785cr that was reported in exceptionally buoyant year of FY24.

- Mortgage (retail): This is a small, but well-run business, with potential to keep growing at 20%+ and generating RoEs in the range of 13-15%.

B. Businesses that will be discontinued

- Mortgage (wholesale): This will run down over next two years and release cash of 3000cr+ over time. Given that they have generally been conservative in lending and are well provided on NPAs, unpleasant surprises are unlikely during the run-down.

- ARC: This business will also run-down over next 3 years and release cash of 1000cr+. Assessing provisioning requirements here is a bit tricky, but based on management commentary, it seems the worst is over.

C. New businesses & higher shareholder payouts

- Syndication & AIF: Over the years of running IB, mortgage & ARC business, JM has developed strong origination skills in real estate, financial, corporate & distressed asset sector. In the new avatar, JM will only do the syndication (and earn fees) and not take the entire exposure on its own books. In areas like land & early-stage finance, they are planning to launch AIFs. Over time, this should contribute to good fee income.

- Dividends: Management has alluded that dividend payouts can improve from FY26

Section 4: How does the risk & reward stack up?

Current price & valuations: At the current price of 125 bucks, the stock is trading at 1.25x P/B and probably at 11x P/E on current year i.e. FY25. The valuations appear cheap on both the counts i.e. if one compares it to NBFCs or to any capital market plays. And if one assumes that JM is able to grow in-line with the growth in Indian capital markets and improve its RoEs & dividend payouts over next few years, a good amount of multiple re-rating can happen. Let’s try to arrive at valuation based on future it down into components:

- Capital market linked business: These businesses are a combination of fee, capital gains and

interest income and delivered profit of 785cr and RoEs of 20%+ for FY24. Surely, these

numbers are linked to capital market and in a bad year, can decline by 10-25%. As such, let

us assign a lower multiple of 10-12x, and value it at 9000cr!

But one must not forget that India is on a secular growth trend and markets will make new highs every few years. The next capital market peak may happen in FY27 or FY28 or FY29 and profits from this division can be substantially higher then. Also, the constitution of earnings would have changed i.e. more profits from wealth management, retail broking & distribution and AMC. Markets have always assigned higher multiples to these businesses.

- Mortgage (retail): Like most other well run affordable housing finance companies, there is no reason for this business to not command valuations of 2-3x on book and can be valued at 1200-1650cr on FY24 numbers and has the potential to grow at 20%+.

- Mortgage (wholesale) & ARC: These businesses will run down and release 4000-5000cr of cash. Even on a conservative basis, we can at least assign book value to them. Ideally speaking, the future syndication & AIF business will generate substantial fee income from FY26 and significantly improve the overall RoEs.

Conservative SOTP: A simple SOTP of the above businesses yields value overall value in the 14,000- 15,000cr range, which corresponds to price range of Rs150-160 based on FY24 numbers. A good amount of re-rating plus compounding can follow, if the management is able to run down the two businesses without any large negative surprises, improve dividends, and turnaround its wealth, retail broking & MF business! Key risk here is a prolonged slowdown in the Indian capital markets.

Note: Prior to FY21, JM has four reporting divisions i.e. AWS, Asset Mgmt, Mortgage and ARC! These were later changed to IB, platform AWS, Mortgage and ARC. If someone wants to reconcile the reported numbers to the numbers in this report, the above adjustments have to be made (AWS + Asset Mgmt = IB + platform AWS).

Greenedge Wealth is a SEBI registered investment advisor. The purpose of the above report is to share a theoretical framework for evaluating turnaround businesses in the capital market sector and should not be constructed as an investment advice.