In our Sep’24 note on JM Financial, we highlighted the improving capital allocation and the possibility of long-term wealth creation for its shareholders. Much has happened in the stock markets as well as at the company level since then and it may be worthwhile to re-visit the investment arguments.

Section 1 – Re-cap of the “pivot” that started in Jun’24

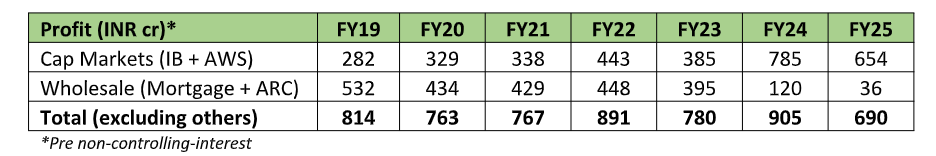

The post-pandemic years of 2021-24 were the strongest years for capital market linked businesses like stock broking, investment banking, wealth management and asset management. However, JM Financials’ headline numbers as well as its stock price remained stagnant. On deeper analysis of JM’s business segments, it was evident that the upside from capital market related businesses (Investment Banking, Broking) was largely off-set by the provisioning in its balance sheet heavy businesses (wholesale lending & distressed credit).

A few more nuances to this segment-wise analysis – Firstly, JM maintained its leadership position in its core business i.e. Investment Banking, Institutional Broking & Corporate Advisory over each of these years; Secondly, the profits in capital market business would have been higher by ~100cr for each of FY24 & FY25, if not for the huge investments towards scaling up of the wealth, AMC, and digital businesses. All these years, it was clear that for JM Financial to get re-rated, something good had to happen in the balance sheet heavy businesses. This much-awaited inflection point came in May’24 when the management made a few strategic announcements:

1) The wholesale businesses i.e. the mortgage & distressed credit businesses will pivot from purely balance sheet driven business to syndication driven business over the next 3 years. This would not only de-risk the balance sheet but also make if a relatively fast churning book.

2) Ramp up of the wealth and asset management business in terms of talent, products, and distribution reach.

3) The dividend pay-out ratios would be significantly improved over time.

Section 2 – The year of re-set(May’24 to May’25)

The first year of any corporate re-set is generally characterized by cleaning-up the past and setting of the direction & tone for the future. For JM, the best part about the re-set was the absence of a major negative surprise during the running down of its wholesale loan book. Also, there has been good progress in setting the tone & direction for the future -- simplification of corporate structure, redefining of business segments, and improved dividends.

Simplification of corporate structure:JM Financial has increased its stake in JM Credit Solutions from 47% to 97% by buying out its partner at a favorable valuation. It has also effectively increased its stake in ARC from ~58% to ~80%. Both these transactions received regulatory approvals in Mar’25. The increased stake not only allows JM to have better control over the cash balances in these subsidiaries but also helps in consolidating the large part of their profits from FY26.

“Low turbulence” run-down in wholesale& ARC business: The wholesale mortgage book has run down from INR49bn in Mar’24 to INR28bn in Mar’25. Although FY25 credit costs of 377cr for mortgage business seems high, we understand that management has made aggressive provisions as a part of abundant precaution (Net NPAs have reduced by ~100cr) and that there is a good possibility of write backs in the coming years.

Improving dividends: Despite no major increase in total profit between FY23 and FY25, dividend amount has been increased from INR1.8 per share to INR2.7 per share. This is clearly an outcome of moving away from balance-sheet heavy business. Also, in its latest earnings call, the management was vocal about its intention to further improve the dividend pay-out.

Section 3 – New reporting & new possibilities

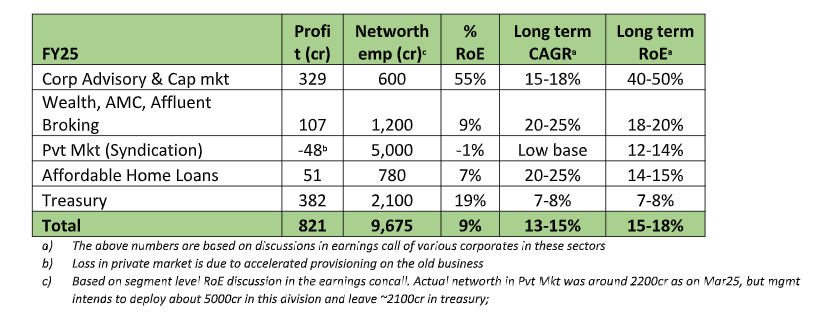

We now have full year data for the new reporting format. It gives us some idea on business level RoEs and how the scale up can happen over time. Below are some observations on each of them:

Corporate Advisory & Capital Markets:On expected lines, this is JM’s crown jewel, with strong growth profile and superior RoEs. The recent Q4FY25 numbers showed that this business has much lower cyclicalitycompared to equity broking, thanks to is pole position in M&A business, which is a counter-cyclical business when compared to IPOs & QIPs. India’s capital markets will remain vibrant for many more years and that leads us to believe that this division will not just be a high RoE business, but also a high growth business! This division is headed by one of the most capable names in Investment Banking business.

Wealth and Asset Management: The initial build-up in each of the businesses holds promise – AMC has created a good niche in small caps and its equity AUM has scaled from negligible levels in 2022 to ~10,500cr recently. Over the next few years, they will also build large-cap focused schemes which can propel the AUM to much higher levels. On the wealth side, JM has strong franchise on the transaction side and is heavily investing to improve its “recurring” franchise.

Wealth & AMC divisionsare witnessing strong investments in terms of management bandwidth, products, research, talent, and customers. Management aspiration is to scale these businesses by 2x in the coming years. As scale benefits accrue, RoEs can start inching up from current levels of 9% to 18%+ levels eventually.

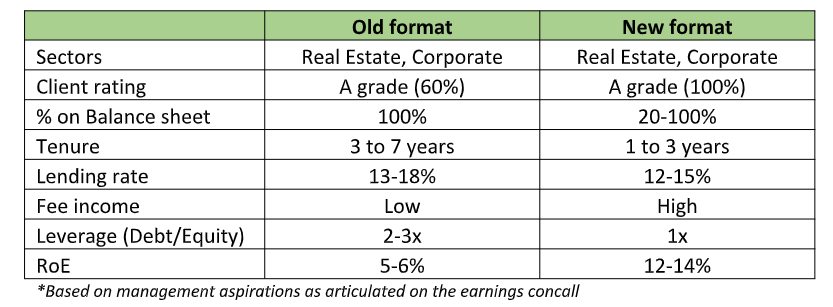

Private Market (Syndication& Private Investments): Wholesale &distressed credit were the two businesses which employed approximately 60% of firm’s equity capital but generated only 5% RoEs. This was due to multiple pain points like changing regulations, prolonged legal resolution process, and illiquidity of underlying assets. Also, the years of 2017-22 were such challenging years that even a small exposure to lower rated developers & corporates became a pain point. A large portion of these exposures have already run down and capital has been freed up.

In the new format, ~5000cr of equity capitalwill be deployed in corporate & real estate deals that are highly rated, have shorter tenures&better underlying liquidity, and have the possibility of being down-selling to other financial institutions, funds, wealth & HNI clients. The management has set-out an aspiration to create balance sheet of ~10,000cr (1:1 on D:E) across real estate, structured finance, corporate LAS, Pre-Pre-IPO & private equity, and bespoke financing. In addition to this, there will be substantial syndication activity which will generate a good amount of fee income. Overall, the management aspires for 13-14% RoEs from this business.

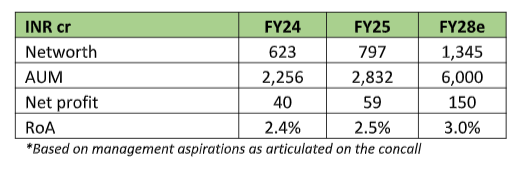

Affordable home loans: From humble beginnings in FY18, this subsidiary has come a long way, growing at 25%+ and generating 2.5% RoAs. Apart from being the only truly retail business within the JM group, it has a unique advantage of having a strong parentage (other listed AHFCs have private equity parentage), which will allow it to borrow at attractive rates and operate at higher leverage. This business can grow to 6000cr in AUM and 150cr in profits by FY28. At that scale and profitability, this entity can become an IPO candidate and command valuation like Aavas, Aadhar, Home First, etc (~3x on FY28 net worth).

Section 4 –An investor’s perspective

Round 1 of re-rating is done!

Any under-valued stock needs a trigger to re-rate. For JM, the trigger for the first round of re-rating was management’s decision to pivot from “balance sheet heavy” business to “balance sheet moderate” business. The stock price did improve from 80 levels to 130 levels. The natural question that comes to an investors mind is if the stock is fairly valued or still trading at deep discount?

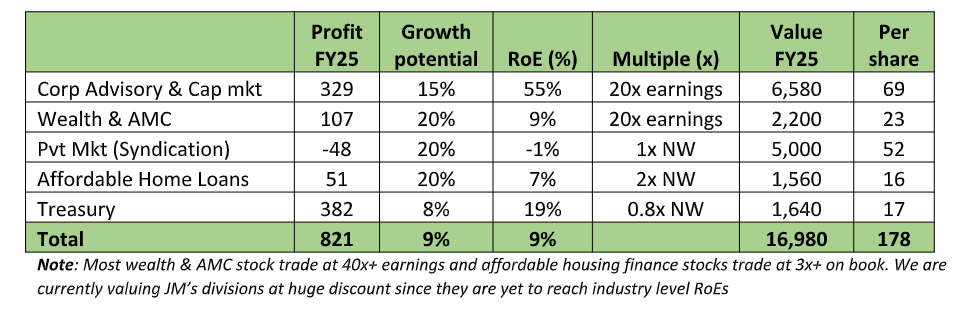

Fee based businesses can be valued based on price-to-earnings (P/E) while balance-sheet heavy businesses are valued based on price-to-book (P/B). Given that JM is a mix of fee-based and balance sheet-based businesses, the best way to value it is using the sum-of-part methodology. Below is an attempt to arrive at fair value of JM Financial

Based on the above, even at CMP of 135, the stock is trading at big discount to its current fair value (we are not assigning any credence to the strong growth that lies ahead).

Round 2 of re-rating – what are Mr. Market’s hesitations?

Given the huge discount to fair value, the market is probably trying to tell us a few things. Although one can never be sure of these things, but let us still attempt to list down these things:

- Wealth & Asset management:You are investing heavily in the business, but we will assign a higher valuation only when we see RoEs approaching double digits

- Housing Finance:Affordable Housing Finance is an attractive sector, but we will give you better valuation when you scale & lever-up a little more

- Private Market & Treasury:We are not too sure if the provisions are over. Also, we are in very early stages of the pivot, hence we will value you at book value or a little discount

Round 2 of re-rating – what can placate Mr. Market?

Investors always love earnings growth and its predictability. If the provisions from the old businesses are indeed over and the new businesses start scaling up,Mr. Market will assign richer valuation multiples to the individual business components and SOTP can be much higher than that suggested by the above table.

- Wealth & Asset management:Increase in overall AUM, rise in proportion of recurring AUM and scale benefits can result in double digit RoEs by FY27-28 for the wealth division. Similarly, the AMC division needs to scale to 25,000cr in AUM by FY27 to reach break-even.

- Housing Finance: The company has the requisite capital, attractive borrowing costs, and good origination capabilities. This subsidiary can command much better valuations if it is able to maintain / slightly improve its RoA on double the current loan size. Most of this is in the realm of management aspiration by FY27-28.

- Private Market & Treasury: The management has been articulating that worst of the provisions are over and there is a possibility of write-backs in FY26 and FY27. If we do witness some write-backs in the coming quarters, the scars of the past will indeed heal.On the new business, markets may take a few quarters to understand the potential.

Do not forget the dividends

With the simplified corporate structure and the light balance sheet approach, JM will have the ability to pay ~50% of its profits as dividends (the remaining can be reinvested in business). That can improve the dividend to INR5 per share over next 2-3years, thus providing an attractive yield to the investors.

Our earlier report on JM Financial "https://greenedgewealth.com/JM-Financial%E2%80%93Getting-back-to-core/index.html"

Greenedge Wealth is a SEBI registered investment advisor. The purpose of the above report is to create a framework for evaluating turnaround businesses in the financial services sector and should not be constructed as an investment advice