Even as the halo around HDFC Bank has reduced over the past few years, the IPO of its subsidiary has created some buzz as well as some excitement in the investing community. The prospective investors are inclined to think that just like HDFC Bank is the best private bank, HDB Financial would be one of the best NBFCs. The existing investors are anxious that IPO is happening at ~3.5x price-to- book vs. in comparison to ~6x price-to-book valuation which the private market was assigning to HDB. So what is really in story for existing as well as prospective investors in HDB Financial?

HDB Financial – Business snapshot

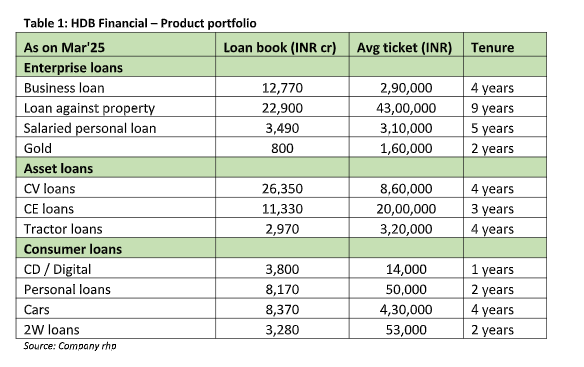

HDB Financial was set-up in 2007 and over the years, has established its presence across the country via its 1,700+ branches and 60,000+ employees. Unlike most of traditional NBFCs which have focus on one or two products, HDB Financial followed a multi-product even in its early days and even today, the only NBFC to offer a wider product suite is Bajaj Finance.

On the face of it, things look good – wide branch network, well diversified product portfolio across consumer and SME sectors, advantage of low cost funding, etc. But does the financial performance also tell us the same thing? Let us compare HDB’s performance v/s other large NBFCs:

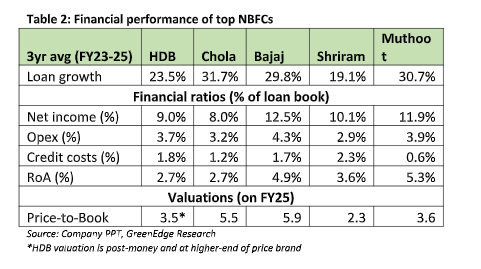

When one compares the three-year performance of HDF Financial with the other top NBFCs in India, the following trends become clear:

Growth: Most of them have grown between 20-30% CAGR, which points to strong performance for all the NBFCs. But the pertinent question to ask here is “how profitable was the growth”?

Net Income: For NBFCs, net income is defined as income accruing from purely lending operations i.e. (Interest income + Fee income + Other income – Interest expense). We can see that HDB’s net income is lower by 100-350bps when compared to Shriram, Muthoot or Bajaj Finance and this is despite HDB’s borrowing costs being 100bps lower than Muthoot & Shriram and in-line with Bajaj Finance

This means that HDB Financials’ overall lending yields are 100-350bps lower than Shriram, Muthoot & Bajaj. This is largely because of the differences in product mix. Shriram is heavy on used vehicles, Muthoot on gold loans and Bajaj on personal loans where yields are high.

Operating cost: Despite earning higher yields, Shriram spends lesser on its operations in comparison to HDB. Muthoot and Bajaj spend only slightly higher amounts than HDB to run their operations.

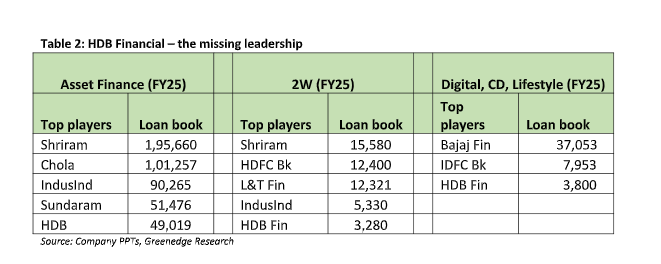

This tells us that Shriram, Chola, Muthoot and Bajaj are more efficient compared to HDB. This higher efficiency comes from relentless focus and leadership in certain products (Used CV for Shriram & Chola, Gold for Muthoot, and personal loans for Bajaj). HDB on the other hand has no leadership in any of the products that it operates in.

Credit costs: This is the surprising part – since HDB has lowest yields, one assumes that HDB would be taking the lowest risk. But when one looks at credit losses (% of loans that are not repaid), we find that despite significantly higher income, Bajaj has lower credit costs in comparison to HDB.

Credit losses are generally a function of the underlying customer segment. The above data tells us that HDB is not able to source as good quality customers as Bajaj or Chola or Shriram or Muthoot.

What is missing in HDB Financial?

If one looks at the best banks in India i.e. HDFC Bank, ICICI Bank and SBI, there is a common link –

they are extremely well diversified in terms of asset products. However, if one looks at the best

NBFCs in India i.e. Bajaj Fin, Chola, Muthoot Fin, Shriram, Sundaram, they tend to have a certain

degree of concentration. This concentration helps them earn super normal profits, which are then

deployed in newer products for diversification.

Even though HDB financial was incorporated as an NBFC, it always had elements of bank like thinking i.e. multiple products, multiple geographies, excessive focus on secured loans, etc. As a result, it never attained expertise, scale, or leadership in any lending product. Thus, there are no easy profit pools available for HDB. They will continue to deal with high operating costs and cyclicality in credit losses as well in the foreseeable future.

What is in store for IPO investors?

While HDB is nowhere close to Bajaj or Muthoot Finance is terms of its business domination or

profitability, the good thing is it is not asking for such high valuation multiples. At the upper end of

the IPO price band of 700-740, it is trading at post money valuations 3.5x on existing book value

which seems reasonable for business that can grow at 16-18% and deliver RoEs of 16-18%.

Chola trades at 5.5x book for a similar RoA profile and there is a good chance that investors may compare HDB to Chola and build an argument for re-rating of HDB. While that can happen in the short run, it is also possible that valuations of Chola get corrected to more reasonable levels. Sustained expansion in valuation multiples would require sustained improvement in RoA (which is not easy). If investors are happy for book value compounding (15-18%), then HDB Financial may not disappoint.

Disclaimer:Greenedge Wealth Services LLP is SEBI registered investment advisor. However, the above article has been written for educational purpose and should never be construed as an investment advice. As a part of our advisory activities, we may have recommended equity and debt instruments of some of the companies discussed in this article to our clients as well as for our personal investment portfolios. The readers are requested to do their own due diligence.