Indians' love for bank deposits knows no bounds! Deposits are comfortable, convenient and worry-free. They are also “by default” i.e. if your money is not invested, it is automatically lying in your bank account. Currently, over Rs. 200 lac crores are placed with banks in deposits!

What do Banks do with Your Money?

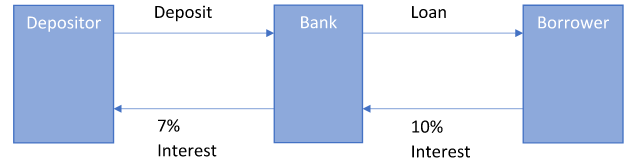

A Bank accepts deposits from depositors (called savers or investors) and pays interest on the deposits, which becomes the income for depositors. The bank then finds a borrower to whom it can lend the money at a higher rate. Borrowers can be large companies, small business owners or even individuals like you & me. The difference between the rate at which the bank pays interest to the depositor and the rate at which the money is lent to the borrower constitutes the bank's operating profits.

How important is the depositor?

The depositor is usually happy with the interest and can generally withdraw anytime. But the bank’s entire economics depend on the depositor accepting the low rate of interest. The difference between deposit and loan rates are used by the bank for funding the fat salaries of bankers, the plush offices, as well as returns to shareholders!

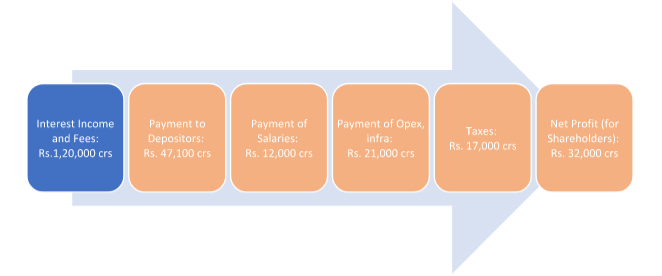

Ilustration of ICICI Bank FY23 Financials – where did the net interest (difference between loan rates and deposit rates) go?

Operating profit (amount after deduction of payment to depositors from interest and fees charged by the bank) of Rs.82,000 cr for the year FY23. This is large enough to:

- Pay for the big, fat salaries amounting to Rs.12,000 cr or ~15% of the operating profit (the avg employee gets Rs10.26 lac and the highest paid employee gets Rs.10 crores)

- Pay for the plush branches, their comfortable sofas, air-conditioning, 3-4 cups of tea a day per employee, maybe their snacks, parties, lunch and dinners – almost Rs. 21,000 crores (about 26% of operating profit)!!

- Ensure that after all the above expenses and taxes (17,000 cr), the shareholders are left with profits of Rs. 31,896 cr.

The lazy depositor is even more important!

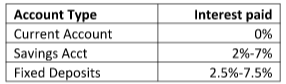

The lazy depositor is the one who keeps a lot of money in savings account (or maybe even fixed deposits), which earns an even lower rate of interest.

Let’s again take ICICI Bank. A very simplistic analysis reveals that if it had to pay just 6% interest on even all the current and savings deposits, the bank would have made only 40% of its actual profits in FY23 which means that the bank made 60% of its FY23 profits because the depositors accepted the low interest rates that the bank offered!! And if the bank had to offer 8% interest rate on all its deposits, the bank would have made deep losses!

Also don’t forget – bank deposits are taxable at your income slab meaning if the bank pays you 7.5% interest, the person at the highest marginal rate of taxation will get only 4.5% post tax! These numbers look even worse if you are evaluating savings deposits! ICICI Bank is just an example; all mainstream banks have the same approach.

Depositor is important, but is he valuable?

If depositors are indeed so important, are they valued by the bank? A large ‘purely’ depositor is not looked at by banks as a savvy investor and hence key target for the bank is to cross sell investment schemes and other financial products where the bank gets to make commissions too.

Now can we do something about the lazy money lying in our bank accounts and fixed deposits? We will address this and many more aspects of fixed income investing in the subsequent parts.

This is an investor education initiative by GreenEdge Wealth Services LLP and is peppered with our opinions. Investors are expected to verify and perform their own due diligence too.