Fixed Deposits – Something’s Surely Not Fixed!

Like many Indians, Sonali prefers to park most of her savings in bank fixed deposits (FDs). She is well aware that due to the safe nature of FDs, the returns on them are low. Yet, she was in for a surprise when she had to renew one of her maturing FD, and could hardly believe that long term FDs were just yielding ~5.0%, the lowest in her lifetime.

What’s happening today has happened before!

Most of us do know that post-Covid, Central Bank action has resulted in a gush of liquidity, which in turn has led to sharp fall in interest rates. Also, it is human tendency to extrapolate the current trend i.e. interest rates will continue to fall. Let’s see if history can offer a different insight:

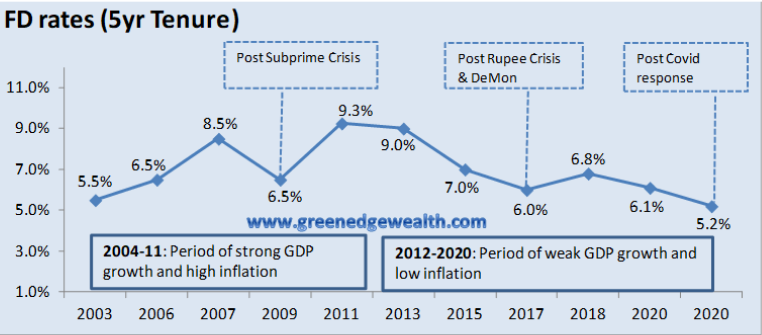

The above is 17 year history of SBI’s fixed deposit rate which we have analysed in light of the important economic events that have transpired over this period. Few things stand out:

• FD rates decline after major economic events i.e. Global Financial Crisis (2009), Rupee Crisis & Demonetization (2013-16) and Covid response (2020). This can be attributed to Central Bank’s intervention after every crisis, to keep the financial system in good health.

• But once the crisis period was over and economy started to recover, the demand for money as well as interest rates went up (2004-07, 2009-12, 2017-18). Thus, interest rates are never static, they keep fluctuating. Extended period of decline is followed by period of rise and vice-versa.

As we see from the chart, interest rates have steadily declined since 2012, as a result of strong global liquidity and declining economic activity in India. The current backdrop is very similar i.e. there is a lot of systemic liquidity and economic growth too is tepid. However, this wouldn’t be a permanent state of affairs. Economic activity is projected to rebound in 2021-22 and that will increase the demand for money and interest rates could well start inching up.

We can never be sure if the FD rates will go back to good old days of 8-9%, but one thing is reasonably clear – that there isn’t much room for the rates to go down further. Interest rates in USA are already close to 0%; Retail inflation in India has crossed 6%, and it’s only a matter of time that industrial activity picks up. All this should result in rates rising again.

But I need to invest today, what shall I do?

Coming back to Sonali’s problem – one of her long term Bank FD has matured and she is looking to reinvest it back. She wonders if she should opt for long term FD tenure despite the low rates? Our suggestion to Sonali is to park the money in a short term FD (6 to 9 months) even thought they offer lower rates. This will give her the chance to re-invest this money in longer term instruments later in 2021, when rates become better.

Also let us not forget that just a few months before the Covid pandemic hit us, many long term government bonds were yielding 7.5%, AAA rated corporate bonds were yielding 9.0% and tax-free bonds were yielding 6.0%. This opportunity may come up again in the coming quarters, so let’s not lock all our liquidity in long term low yielding instruments at this juncture.

Feel free to reach out in case you need help with your Fixed Income investments.

PS – Name has been changed to protect the identity of the individual.