Humanity’s fascination with gold is 4,500 years old. Current opinions &emotions about gold swing from it being an unproductive investment with no cashflows, to being a store of value, to being a

hedge against inflation & human madness, to being a measure of wealth, to being an investment

avenue, to being a bet against the declining dominance of USD and so on.

While all of the above arguments hold some water, it was the last opinion that caught our attention and called for more analysis. Before we get into more details, it is important to understand the three major sources of gold demand and their respective history:

- Ornaments: Indians & Chinese have historically been the largest consumers of gold ornaments and that demand has remained steady over the years. Annually, Indians & Chinese buy around 700 tons and 900 tons respectively. It is estimated that all Indians together own around 25,000 tons of gold, which is roughly 10% of world’s entire gold (and 3x the amount held by US Fed).

- Central Banks: Most central banks across the world hold a combination of gold, USD, and other foreign currencies in their reserves, since they are needed for exchange rate stability & trade settlement. Prior to 1974, gold used to constitute ~75% of global central banking reserves. Over the next 50 years, USD became more dominant and gold holdings as % of overall reserves touched an all-time low of 16% in 2016. This number has recently improved to ~20% due to actions of Chinese & Russian central banks (to reduce USD dependency).

- Investment demand: While this is the smallest sources of demand, it is important to note that over the last 50 years, gold has been completely dropped off from the portfolios of US & West Europeans. In a recent wealth survey, 71% of financial advisors in US said that their client’s allocation to gold is between 0% and 1%! This is not only the lowest in the history, but also very different from a typical Indian household which has up to 15% of its wealth in gold.

From the above factors, it is clear that two of the three sources of gold demand i.e. demand from Central Banks and demand for investment are close to their 50-year lows. Should one conclude from

this that the era of gold is over? Or is there anything to suggest that gold is set to reverse this 50-year trend of demand decline?

Can the central bank demand for gold rise?

Annual gold purchase by global central banks averaged around 400 tons during 2011-21, but surged to ~700 tons in 2022, buoyed by demand from China & Russia’s central banks. This period also

coincides with increasing geopolitical tensions – the global dominance of US is being increasingly challenged by countries like China & Russia. Smaller countries too are doing their bit by entering into

bilateral trade settlements (India-Iran), (Arab-China), etc.

In the past, US had successfully warded off the threats to its currency. But the recent situation seems a little different, because the world is increasingly getting exasperated with the America’s

gross misuse of USD’s reserve currency status (first in 2009 and then in 2020 by printing massive amounts of money). Thus, US will be busy fighting inflation, debt repayments, bond reissuances, and economic slowdown in the coming years and may not be able to effectively thwart the threat to USD.

In such a backdrop, non-US central banks may become keen to reduce their large stock of USD (China has already started) and diversify into other currencies or gold. Many macro commentators

opine that in periods of uncertainty, central banks a more likely to increase their gold holdings.

Can the investor demand for gold revive?

Since Indians and Chinese own gold in good quantities, the discussion here will pertain to investors in US, who over the years have almost shunned gold in favor of the typical 60:40 equity-debt

portfolio. The debt portfolios worked well for them (to reduce volatility) since interest rates in US have more-or-less declined in a straight line from 15% to 0% over the last 50 years.

However, that trend got broken in 2022 and interest rates rose from near zero levels to 5%. For the first time in 50 years, bond portfolios are seeing capital losses and witnessing volatility that is higher than gold. Right now, the hope is that interest rates will soon decline to 2-3% levels and the 60:40

portfolios will be repaired. If this does not materialize, investors will be forced to look at gold to

diversify their portfolios.

Is there enough gold to meet the above demand?

At an aggregate level, annual gold demand has remained static for many decades due to the above-mentioned reasons. In such a static demand environment, gold mining companies had no incentives

to look for new mines or improve their production efficiency. In case there is an additional demand for 300-tons on gold in 2024 due to the above-mentioned factors, there is no way that the mining companies can meet it. The new buyers will have no choice by to bid up gold prices.

What is the gold price telling us?

Gold price has made a lifetime high in many currencies including INR and is just 5% away from making new all-time highs even in USD. While this is a sign of strength, it assumes even more

significant because it has happened despite the sharp rise in interest rates in US (in the past, gold

prices would decline when bond yields increased).

US stock markets and gold has had an inverse correlation since 1950s. US markets did very well 1980-2000 and 2010-2021 while gold did very well in 1970-80 and 2000-2010. Based this, it seems

gold can do well between 2021-31. If one looks at the ratio of market value of Gold v/s S&P 500, it is

at depressed levels seen only twice in the history i.e. the inflationary era of 1970s and the tech bubble of 2000. We all know that gold prices rallied 2-3x in the years that followed.

What should investors do?

While no one can ever know with certainty if history will repeat, the current backdrop offers one of the most favorable environments for gold prices to rally. Ideally, we advocate investors to have 5-10% of their wealth in gold. But given the possibility of gold doing well in the next 2-4 years, one can

consider a slightly higher allocation as well.

Trivia – Update on Gold & Amul butter

India’s ancient economic & food sciences have assigned huge importance to Gold and Ghee, so much that Charaka Samhita, the Sanskrit text on Ayurveda, opines “sell your gold if you have to, but never stop eating ghee”. Thankfully, all of us are now in situation that we can own gold and eat butter as

well. Below is an illustration of how owning gold can ensure that you never have to worry about the

rising prices of ghee/butter!

| How much butter can you buy? | 1970 | 2021 | 2023 |

|---|---|---|---|

| With One rupee | 100gm | 2.4gm | 2.2gm |

| With One US$ | 0.60kg | 0.15kg | 0.14kg |

| With One gram of gold | 1.5kg | 11kg | 12kg |

Note: We do not understand or share the same optimism for Bitcoin and other crypto – currencies. Many of the data points mentioned in the above report have been obtained from blogs, articles and videos of investors whom we respect and follow. The above article should be treated as educational

and not be construed as an investment advice.

Analyzing the long-term case for investing in PSU Banks Let us analyze if the four key reasons that were responsible for the strong rally in PSU Banks are equally valid today or they have become stronger or weaker:

1. Reduced government interference: The bad lending practices that prevailed over 2009-14 were responsible for the NPA crisis of 2016-21. Reforms like PCA, IBC, merging weak Banks with strong ones, and inducting private sector talent were initiated. To us, the biggest reform seems to be the reduced government interference in lending and increased government oversight into systems, processes & people. That more or less continues till date.

2. Strong credit cycle: Indian Banking system has witnessed good credit growth and asset quality performance over FY22 & FY23. The good asset quality performance may extend well into FY24 & FY25 because indicators like corporate balance sheets, household savings, urban & rural

wages and real estate prices are strong. However, we may have already made a high base for growth and only those PSU Banks with capabilities in retail & SME may deliver double digit growth.

3. Building capabilities: Prior to 2018, most PSU Banks did not have capabilities to do retail lending or earn fee income that is not related to lending. Lately, we have seen that BoB, Indian Bank and Union Bank have taken initiatives to improve their retail capabilities. We have also seen that

tech solutions are increasingly being used to service the customers (Yono SBI). However, challenges around talent gap in the PSU banking sector remains high and success if any will be very slow.

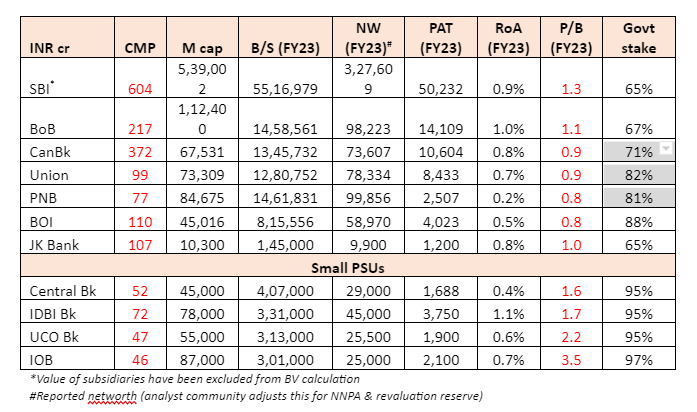

4. Attractive valuations: In early 2021, we were at a juncture where most PSU Banks were trading at 0.4-0.8x book and growth & profitability (avg RoA = 0.4%) was about to improve. Two years later, growth and profitability both have improved (avg RoA = 0.8%), but so have the valuations

at 0.8x-3.0x book (table below). Thus, re-rating can no longer be a big lever and only those PSU Banks will re-rate who can demonstrate decent growth.

As we have seen from the above arguments, that the case for secular rally in all PSU Banks today is not as strong as it was in 2021. Hence, it’s time to adopt a stock specific approach. Based on the business strength, we classify the PSU Banks in to four categories:

Category 1 = SBI, BoB

- These are the most well-run PSU Banks and have some capabilities in retail & SME lending

- Credit costs are at their lows of 0.3-0.4% and RoAs are close to highs of 0.9-1.0%

- RoA improvement if any will be modest and may not sustain

- Valuations re-rating will be slow, that too if RoAs remain at these decent levels for FY24 & FY25

- Stock returns should be in-line book value growth or RoEs (Estimate for FY24 & FY25 = 15%)

Category 2 – Canara, Union

- They don’t have retail/SME capabilities of SBI or BoB, but they are better managed than others

- Credit costs for FY23 were around 0.8-1.2%, so there is scope for improvement in FY24 & FY25

- RoAs will touch 1%+ in FY24 & FY25, but eventually, it may revert to 0.8%

- Stock returns can be decent since there is re-rating potential in addition to book value

compounding

Category 3 – PNB, BOI

- These are large PSU Banks, but rank one notch below Canara & Union in terms of capabilities.

- Credit costs for FY23 were around 1.2%, so big scope for improvement in FY24 & FY25

- RoAs will touch 0.6-0.9% in FY24/FY25, but eventually, it may revert to 0.7%

- Stocks have already run-up, re-rating potential is limited

Category 4 – Smaller PSU Banks

- They rank lowest in terms of business capabilities (CASA ratio, fee income profile, retail lending)

- Currently, they are reporting RoAs of 1%+, but once the NPA recoveries are over, RoAs will

revert to lower levels of 0.6% - Hence, they should not be trading above book value. But since the free float is very low (govt

holds more than 90%) and there is buzz about privatization, there is irrational exuberance here. - Valuations re-rating will be slow, that too if RoAs remain at these decent levels for FY24 & FY25

- Unless privatization plays out, investors in this category can see good amount of pull-back.

Currently, the issues that are worrying the investors in PSU Banks are the problem of peak NIM and the impact of IND-AS migration. We believe that NIMs will stabilize in the next two quarters and till then, the improvement in credit costs will help in sustaining the profits. The worry on IND-AS migration is a little too early in the day, since by FY26, the ECL model will have data related to 3 good years i.e. FY23, FY24, FY25 and this may result in a much lower provisioning number.

Many investors still believe that the entire PSU Banking pack can re-rate further by 10-20% (that fair valuation for SBI can expand from 1.3x to 1.5x; and that will commensurately push up valuations for all other PSU Banks). However, we don’t want to base our investment thesis on sector level macro

assumption, since our micro analysis suggests that the only a few PSU Banks have the room for growth & asset quality surprise.

Disclaimer: We are SEBI registered investment advisors and Research analysts and would have recommended some of the stocks or bonds to our clients. The above views reflect our independent judgement at current point in time and should not be construed as investment advice.

]]>the stock markets across the globe have been hitting 52-week highs or life time highs. While it is surely a time to rejoice and celebrate, it is also the time for the ritualistic contra thinking, some of which is useful and some of which is only for the sake of satisfying one’s intellectual curiosity.

Is the current rally justified? India has not only recovered well from the Covid shock, but has also been able to capture benefits in the manufacturing sector arising out of the geopolitical war between China & US. Record number of new factories are coming up; record number of new trains, aircrafts, power & defence equipment are being ordered; record numbers high end homes, cars, airline tickets and hotel rooms are being booked. The banking system earned more than 300,000cr in profits in FY23 and is in best ever health in 15 years.

A closer look at various global markets also tells us that there is a noticeable difference between the market rally in India and that of developed countries like US, UK and Australia. The Indian markets have decisively crossed previous life time highs and marched ahead, while the other markets, although at 52-week highs, are still some distance away from previous life highs. Another big difference is that the rally in US (Nasdaq) is driven by only 7 or 8 large stocks. In India, the rally is very broad based, spread across 10’s of sectors and 100’s of stocks. All these are technical factors that point to the fact that Indian rally is stronger than its peers.

On the macro front too, there is one major difference between India & the developed economies – India has always lived with 6% inflation and 8% interest rates and grown despite that. On the

contrary, US & Europe have been addicted to low inflation & interest rates since early 2000s and the younger generation there is getting their first taste of elevated inflation & interest rates. In such an environment, India’s economic growth can significantly outshine other developed economies and attract decent FII flows for many years.

All the above factors lead us to conclude that the current rally is resting on solid foundation. Some of the internal risks are – uneven spread of monsoons, drastic climatic events and the possibility of adverse outcome during the 2024 national elections. Beyond these, the risks to Indian economy are

mostly external i.e. global volatility and commodity inflation.

Should one stay invested or book profits? The temptation to sell and book profits after an elongated market rally is generally high. It’s almost as if there is a subconscious fear that markets will crash and you will lose your profits. But before doing so, one must ask this question – In a growing country like India, is this the last time that markets will be at all-time highs? If we look at the history of our markets since 2008, the index has made new all-time highs on more than 500 of the 3750 trading days (Sensex has moved from 15,000 to 66,500).

There is high probability that such a pattern will repeat over the next 10 years as well, that Indian markets will keep marching forward as our economy keeps growing. Indian markets are not like

Japan or UK or Australia, where markets haven’t made lifetime highs in a few decades. The only kind of stock selling that makes sense right now is to get out of the frothy pockets, where share prices have gone far beyond the fundamentals. In the current context, some PSU stocks, SME stocks and low liquidity stocks fit the bill for booking profits.

Should one invest additional money at these elevated levels? We all are tempted to invest more money when the going is good, and hold back when the tide changes. While one should continue their regular investments, one can wait for a cool off period to deploy big capital. Do remember that there will be a flurry of negative news when market cools off – if you wish to time the markets, you should have the emotional grit to during such times.

Another point is that even in such markets, there are pockets of opportunities – certain new age companies, chemical & pharma sector, banks & NBFCs, manufacturing, dairy & real estate sectors fit the bill in the current context.

Trivia – Home (not so) sweet home!

Owning your house has been a universal dream from times immemorable. So intense is this desire that lakhs of Indians have pursued it over the last decade despite it being an economically sub- optimal decision (we have written many times over 2014-20 that the Indian real estate market was extremely over-valued and that renting is an economically better decision).

Residents in countries like US, Canada and UK were luckier – buying the house & making mortgage payments was more economical v/s renting. And thanks to the declining interest rates over last 20

years, housing prices have steadily increased and created lot of wealth for the home owners until 2022. Things seem to be changing since mid of 2022, as the 30yr mortgage rates have increased from 3% to 7%. The simple mathematics around income & mortgage payments suggests that housing prices in US need to decline by 40% in theory as explained below.

While an existing home owner in US continues his old mortgage at 3%, the new buyer will have to shell out 7% on his mortgage. That translates into an additional annual payment of US$30k for the

new buyer vs. the existing owner for a house costing US$1 million. To reach parity levels with existing owner, the new buyer needs to buy for US$600k i.e. a whopping ~40% discount! Of course, no one is going to sell their US$1 million house for US$600k since that would mean going back to 2012 prices. Hence, as it stands now, it’s upon the buyer to shell out a lot more for the same house. Not many would have the additional disposable incomes or the loan eligibility to do it. Thus, in the near term, the number of transactions in the housing market will start drying up.

If the interest rates stay high for longer, it is getting clear that either US housing prices will have to crash (less likely) or they will go into a decade long period of time correction (more likely). The same could be the case for US stock markets, given the peak margins, peak valuations, the tight labour markets, and the un-anchored inflation expectations. Most fund managers in US are looking to diversify their investments in emerging markets and India is the only market with size & depth! If foreigners are singing the Indian song, why should Indians be left behind!

]]>

Microfinance (MFI) & 2W finance were the worst impacted amongst the various segments of BFSI sector. While 2W finance is still struggling to recover, the recovery in MFI sector started sometime in mid of 2022 and the Q3FY23 results & commentaries of various players suggest that the momentum is set to get stronger. The current macro & micro set-up for the MFI sector can be termed as the “goldilocks situation” due to the following reasons:

1. Lower loan losses: Pandemic pain for most players is about to get over. Since we are in the early stages of the cycle, most of the analyst estimates suggest losses of less than 2% for FY24 vs. 3-5% seen over the pandemic years.

2. Explosion in the “income” line item: Post the revised RBI guidelines, most MFIs have hiked theirlending rates by 200-350bps. Also, in absence of fresh NPAs, there will no interest income reversals. Thus, after a long time, MFIs will earn “full card rate” on the entire portfolio.

3. Strong loan book growth: After a long time, loan book is set to grow by 25-40% in FY24 for

various players. In the near term, growth creates its own virtuous cycle in terms of operating leverage and the repayment behavior of clients, both of which adds to the bottom-line.

How long can the upcycle last?

While most of the reasons stated above are well known & talked about, the biggest unknown is the length of the upcycle. If one looks at all the past cycles, it appears that the cycles are getting shorter. May be because the sector is far more penetrated & matured than a decade ago. Or may be the sector has grown faster than inherent capabilities of the underlying borrower.

| Period | Length | Sector size at start (cr) | Lending rates (large players) | Reasons for ending | |

|---|---|---|---|---|---|

| Upcycle 1 | 2006-10 | 5 years | 6,000 | 28-30% | AP crisis |

| Upcycle 2 | 2013-16 | 4 years | 30,000 | 20-25% | Demonetization |

| Upcycle 3 | 2018-20 | 3 years | 1,35,000 | 18-20% | Problems in East & Covid |

| Upcycle 4 | 2022-? | ? | 3,00,000 | 21-23% | ? |

*Source: MFIN Micrometer, company drhp, Greenedge Research

Are there any major unseen risks?

Another aspect which makes us circumspect about the length of the cycle beyond FY24 is the 200-350bps lending rate hike taken by various players. These hikes are larger than warranted by rise in borrowing costs. Post the AP crisis, the large MFIs developed a view that lending rates below 20% significantly reduces the risk of political interference. To that regard, lending rates of large MFIs like SKS, Bandhan, Ujjivan, Credit access remained in the 18-20% band over 2016-20.

But so deep were the covid losses, that MFIs have raised lending rates by 200-350bps to repair their balance sheets and we are once again in the 22% range. This despite the 10x increase in size and manifold increase in technology usage over the last 8 years. It tells us about how difficult the segment is and that one cannot write-off the soft political risks. As equity investors, the best we can do is not to assign peak valuations to peak earnings of FY24.

Company section

Despite the different regulatory structures i.e. NBFC-MFI, SFBs or NBFCs, microfinance sector has generally been homogeneous – most players follow some form of JLG model, they grow fast in an upcycle and they lose a good amount in downcycle. But beyond this, there are subtle differences like geographic diversification, process diligence, ability to manage large number of employees, and leverage. For a good player, all of the above factors culminate into relatively lower credit losses in bad cycles. Below is list of losses suffered by major listed players.

Credit losses of MFI players

| INR cr | Total provisions (FY20 – FY23e) | MFI book (as on Mar'20) | % Loss |

|---|---|---|---|

| Bandhan Bank | 17,098 | 46,190 | 37% |

| Ujjivan SFB | 2,128 | 10,377 | 21% |

| Suryoday SFB | 905 | 3,014 | 30% |

| CreditAccess | 2,034 | 11,996 | 17% |

| Spandana | 1,846 | 6,829 | 27% |

| Fusion | 829 | 3,607 | 23% |

| Arman | 134 | 860 | 16% |

*Source: Company presentations; (assumes that all provisions relate to MFI loan book that was existing just when covid hit)

Bandhan Bank (CMP = 230; Mcap = 36,500cr)

Long term assessment: It is India’s largest MFI and stands out for being the worst impacted as well.Apart from the pandemic generated pain, company specific factors include lack of geographic diversification (>50% of MFI book in West Bengal & Assam), overleveraging its customers under the garb of warding-off competition (average ticket size was 2-3x of industry) and extreme under-investments in non-MFI businesses (branches, sales, technology, brand).

Until as late as Sep’21, management attributed most of the problems to the pandemic. The deep losses even after the huge write-offs in FY22 has probably forced to change track and talk about asset & geographic diversification. Even if the intent is whole hearted, it will take years of investments in tech, people and processes to build a good bank (which means much higher opex). Till then, earnings will continue to be extremely cyclical with huge dominance of microfinance on the asset side and highly interest rate sensitive customers on the liability side.

Short term assessment:The benign macro cycle offers some hope in the interim. If most of write-offs are genuinely over in FY23, Bandhan can report a big jump in profits in FY24 courtesy the 200-250bps lending rate hike, improvement in % of assets that will earn interest (reduction in stressed portfolio) and sharp reduction in loan losses.

| INR cr | FY20 | FY21 | FY22 | FY23e | FY24e | Comments |

|---|---|---|---|---|---|---|

| Loan book | 71,850 | 87,040 | 99,340 | 1,06,790 | 1,30,904 | Good growth possible |

| Net income | 7,873 | 9,585 | 11,537 | 11,206 | 14,838 | 250bps higher lending rates |

| Provisions | 1,393 | 3,820 | 7,885 | 4,000 | 1,188 | Benign cycle & end of NPAs |

| PAT | 3,024 | 2,205 | 124 | 2,019 | 6,015 | Big jump in profits |

| RoA | 4.3% | 2.2% | 0.1% | 1.5% | 3.8% | Avg across cycle = 2.5% |

| RoE | 23% | 14% | 1% | 11% | 26% | Avg across cycle = 15% |

Source: Company presentations; (projections are just for illustrative purpose)

Valuation: Despite trading 50% below the pre-pandemic levels, current valuations at 1.9x on Mar’23

aren’t exactly cheap, given the deeply cyclical nature of its business. If FY24 is indeed a good year for earnings, the stock can give 20-30% returns, in-line with the increase in its networth. Anything beyond this should be contingent on the management’s ability to reduce the cyclicality of its business model.

Ujjivan SFB (CMP = 27; Mcap = 5,200cr)

Long term assessment: Apart from being one of the well-run MFIs, Ujjivan had the distinction of

being the most geographically diversified MFI as well. However, things changed post conversion to small bank. Their initial strategy around branches & liabilities misfired. They then tried to rope in a banker CEO, but that strategy too failed. The old founder re-took control of the management in late 2021.

Amidst all this, Ujjivan still remains a well-run MFI. But its banking piece continues to struggle. Despite spending 1,000s of crores in opex, its liability franchise as well as fee income (non-lending related) franchise remains weak. It is indicative of two things – that banking franchise is extremely tough to build despite throwing lot of money on it and that the MFI mindset still reigns supreme within the company. 70% loan book and 90%+ of profits still come from the MFI business which is deeply cyclical. Any change in this will be very gradual.

Short term assessment: Ujjivan is already reporting an upswing in FY23 earnings due to early

recognition of losses (9MFY23 losses are close to zero) and having raised lending rates from 19% to 21% in May’22. It may not be easy to grow earnings at double digit rate over the base of FY23 since Ujjivan will have to contend with rising deposit costs & normalization of credit losses in FY24.

| INR cr | FY20 | FY21 | FY22 | FY23e | FY24e | Comments |

|---|---|---|---|---|---|---|

| Loan book | 14,153 | 15,140 | 18,162 | 21,895 | 27,644 | Good growth possible |

| Net income | 1,956 | 2,040 | 2,087 | 3,103 | 3,751 | Impact of rising deposit rates |

| Provisions | 171 | 799 | 1,118 | 40 | 310 | Normalization of credit costs |

| PAT | 350 | 8 | -415 | 985 | 901 | Big jump in profits |

| RoA | 2.4% | 0.0% | -2.1% | 3.9% | 2.8% | Avg across cycle = 1.4% |

| RoE | 15% | 0% | -15% | 28% | 19% | Avg across cycle = 9.6% |

Source: Company presentations; (projections are just for illustrative purpose)

Valuation: Stock trades at 1.25x on FY23 book value, which isn’t expensive. But given that cross-cycle RoEs are around 10% or close to cost-of-capital, it’s not easy to build a case for permanent improvement in valuations. Stock can give 20-30% upside in next 12 months purely based on book value compounding. Returns beyond that depends on the length of MFI cycle and ability to reduce

cyclicality of earnings.

Despite much higher MFI losses, Bandhan has higher RoAs & RoEs compared to Ujjivan. This is because Ujjivan has spent much more than Bandhan in trying to build a banking franchise. It’s a different matter that both remain heavily dependent on MFI sector and have to offer high rates to attract depositors.

Suryoday SFB (CMP = 99; Mcap = 1,050cr)It is the smallest among listed SFBs. In many areas of life, small can be beautiful. But this is surely not true in the banking domain, where scale becomes very important to success. The small scale of operations doesn’t allow Suryoday to spend much on banking franchise (CASA = 9% of borrowings) and its not possible to scale profitably without spending. It’s more like a chicken and egg problem.The pandemic performance of its MFI book (~65% of total loans) puts it in mid-tier amongst the MFIs. While the cyclical upturn will lift all boats including Suryoday, small size is going to remain an

impediment for times to come. Valuations at 0.7x current book is the only comforting factor.

Credit Access Grameen (CMP = 990; Mcap = 15,500cr)

Long term assessment: CAG is India’s largest NBFC-MFI and also one of the best run MFIs, visible in the lowest credit losses during the pandemic and the fastest return to profitability. This despite having acquired a mid-sized MFI just before the start of pandemic speaks volumes about the management ability. Operating in rural areas and following the best practices in terms of collections & customer leveraging, Credit Access is the cleanest play in the NBFC-MFI space.

Short term assessment: Upswing in earnings has already started in Q3FY23. With good growth,higher lending rates and cyclically low credit costs, FY24 will witness 5%+ RoAs.

| INR cr | FY20 | FY21 | FY22 | FY23e | FY24e | Comments |

|---|---|---|---|---|---|---|

| Loan book | 11,996 | 13,587 | 16,599 | 20,749 | 25,313 | Good growth on anvil |

| Net income | 1,127 | 1,537 | 1,766 | 2,300 | 2,944 | Lending rates increased |

| Provisions | 237 | 771 | 597 | 429 | 368 | Normalization of credit costs |

| PAT | 328 | 131 | 357 | 728 | 1,140 | Big jump in profits |

| RoA | 3.4% | 1.0% | 2.4% | 3.9% | 5.0% | Avg across cycle = 3.1% |

| RoE | 13% | 4% | 9% | 17% | 22% | Avg across cycle = 13% |

Source: Company presentations; (projections are just for illustrative purpose)

Valuations: Current valuations at 3.3x on FY23 book adequately reflect the relatively lower cyclicality in earnings and management pedigree. Expecting valuation expansion from here isn’t a good idea since we have seen in the past two down cycles (demon & covid) that even the best players suffercyclicality in this sector. Thus, the best case here should be book value compounding or 15-25% returns in FY24.

One point to note here is that well run NBFC-MFIs trade at higher valuations v/s Bank-MFIs. Part of the reason is NBFCs don’t have to spend huge money on building a banking franchise (and we have seen poor outcomes from most SFBs except Equitas & AU) and there is always an option value interms of a large bank acquiring the NBFC-MFI.

Fusion MFI (CMP = 400; Mcap = 4,000cr)

Long term assessment: Fusion MFI has been one of the fastest growing MFIs in the past 7 years and also among the better geographically diversified. Ability to continuously raise equity capital at the right time has enabled it to grow through demonetization as well as pandemic. The credit losses look optically low due to the high growth, but when one looks at static pool analysis, Fusion’s asset quality performance is mid-tier (23% losses on Mar’20 portfolio).

Fusion’s loan book has grown by 12x in past 7 years or 45% CAGR, which is almost 2x of the sector growth. Generally speaking, MFI business is very operations intensive in terms of getting the right staff & establishing right processes. Pulling off such high growth without any lose ends will be a sort of miracle (but miracles do happen). Not to mention that over the past few years, there were

disputes between the original founders, private equity investors & SIBDI (details available in drhp) and the founder promoter has less than 5% equity left in the company.

Short term assessment: We have already seen two good quarters post the IPO. The fund raise andthe benign macro will ensure this continues for FY24 as well.

| INR cr | FY20 | FY21 | FY22 | FY23e | FY24e | Comments |

|---|---|---|---|---|---|---|

| Loan book | 3,607 | 4,637 | 6,786 | 8,822 | 11,027 | Good growth on anvil |

| Net income | NA | 498 | 705 | 1,088 | 1,409 | Lending rates increased |

| Provisions | 73 | 221 | 369 | 167 | 202 | Normalization of credit costs |

| PAT | 70 | 44 | 22 | 376 | 506 | Big jump in profits |

| RoA | 1.9% | 0.9% | 0.3% | 4.3% | 4.6% | Avg RoA across cycle = 2.4% |

| RoE | 8% | 4% | 2% | 21% | 20% | Avg RoE across cycle = 11% |

Source: Company presentations; (projections are just for illustrative purpose)

Valuations: Current valuations at 1.8x on FY23 book look reasonable when compared to well-run MFIs like CreditAccess and Arman. May be the market is adequately building in for risks-factors like large un-seasoned book, low promoter stake and average RoEs across cycle of ~11%.

Spandan Sphoorty (CMP = 600; Mcap = 4,260cr)

Long term assessment: Spandana has crossed many critical milestones – survived AP crisis, emerged out of CDR, withered the pandemic storm and stabilized after the bitter fight between ex-founder and current promoter. After all this, the balance sheet still remains well capitalized and the new management is in place and working towards re-establishing the building blocks i.e. people,

processes & raw material. If the execution is good, FY24 can be the first significant year of profits.

Short term assessment: Borrowing costs are slated to go up, since Spandana is re-starting its relationship with lenders. But that will more than adequately be off-set by increase in lending rates (200bps higher than competitors). FY24 can be the first year of mid-teen RoEs. However, Spandana will have to moderate its strategy of higher borrowing & lending rates, once things stabilize.

| INR cr | FY20 | FY21 | FY22 | FY23e | FY24e | Comments |

|---|---|---|---|---|---|---|

| Loan book | 6,829 | 8,157 | 6,089 | 6,698 | 8,372 | Good growth on anvil |

| Provisions | 274 | 644 | 481 | 448 | 151 | Normalization of credit costs |

| PAT | 337 | 129 | 70 | 144 | 480 | Big jump in profits |

| RoA | 6.0% | 1.7% | 1.0% | 2.3% | 6.4% | Avg across cycle = 3.5% |

| RoE | 15% | 5% | 2% | 5% | 14% | Avg across cycle = 8% |

Source: Company presentations; (projections are just for illustrative purpose)

Valuations: Current valuations at 1.3x on FY23 reflect the chequered past and a modest future. If the management is able to demonstrate good growth and profitability, there is some scope for improvement in valuations.

Arman (CMP = 1405; Mcap = 1,193cr)

Long term assessment: Arman is small but well-run MFI. It ticks many boxes including good geographic diversification, highly profitable operations, lowest credit losses during demonetization & pandemic, and highest shareholding by founder-promoter. High involvement of the founders and adequate risk management should ensure that Arman will continue to be better than the sector in years to come.

| INR cr | FY20 | FY21 | FY22 | FY23e | FY24e | Comments |

|---|---|---|---|---|---|---|

| Loan book | 860 | 814 | 1,233 | 1,726 | 2,417 | Good growth on anvil |

| Provisions | 20 | 55 | 37 | 22 | 36 | Normalization of credit costs |

| PAT | 42 | 11 | 32 | 83 | 105 | Big jump in profits |

| RoA | 5.4% | 1.3% | 3.1% | 5.6% | 5.1% | Avg across cycle = 4.1% |

| RoE | 28% | 6% | 16% | 30% | 26% | Avg across cycle = 21% |

Valuations: Current valuations at 3.4x on FY23 book adequately reflect the “better than sector” long term performance. Investors can continue to expect book value compounding for the years to come.

Investor strategy – Create a barbel!

Given the high certainty in the near term and the usual uncertainty in the long term, investors are better off playing the barbel strategy i.e. to own a combination of well-run MFI (which will at least ensure book value compounding) and a turning around MFI (which can give higher returns IF the turnaround happens)!

- Barbel 1:CreditAccess, Arman

- Barbel 2:Bandhan, Ujjivan, Spandana

For those who do not like investing in deeply cyclical sectors, they can invest in short duration bonds of some of the MFIs. Balance sheets are well capitalized, macro cycle is benign and micro looks strong for FY24. Many of these bonds offer yields in the range of 11-12% and are a part of GreenEdge Wealth’s high yield bond baskets.

Disclaimer: We are SEBI registered investment advisors and Research analysts and would have recommended some of the stocks or bonds to our clients. The above views reflect our independent judgement at current point in time and should not be construed as investment advice.

Despite most of us having steadily moved up the economic ladder, we still wait for a mega sale to buy our cars & TVs, morning show to get a discount on pricey multiplex movies, off-season stay at Taj Hotels and, the “sabse sasta” day sale to buy grocery & fashion items (I was forced to spend a few hours in an overcrowded mall this Republic Day & this experience probably has a role to play in today’s memo). It’s only logical that this behaviour percolates into investments as well.

Breaking this urge to “time the investments” requires deep thought and training. Talking from my own experience, it took me six years (2004-10) of first-hand exposure to the stock markets to realize & internalize this myself. Therefore, while I continue to have more than 100% belief in the standard response that I used to give in the past on “timing the market”, I am going to attempt and give a different answer the question “Is this a good time to invest more money in the market?”

A lot of froth has cleared in the last 13 months!

In early 2022, there were many pockets of froth globally as well as in India. We are all well aware of the burst in crypto, global tech stocks, and Indian new age stocks! Memes like “Zomato is now cheaper than Tomato” or “2 share de do aur Nykaa ka lipstick le lo” or “Paytm karo par invest kabhi mat karo” describe the enormous wealth destruction in a lighter note.

Beyond these obvious pockets of euphoria, many lesser-known pockets of excesses have also been cleared. For example, pharma & chemical stocks like Divis, Laurus, Gland, Strides, Dr Lal, Deepak Nitrite etc have corrected up to 50% from top. Concept stocks like Dixon, Amber, IEX and IndiaMart too have come to more realistic levels. Even the high-quality stocks like Bajaj Finance, Dmart, Asian Paints, Dr Lal, Voltas, Whirlpool, Jubilant Foods and CDSL have seen considerable correction. And last but not the least, Adani group of stocks too have started correcting.

Collateral damage from Adani Group, if any, will be limited

Since this is currently the most talked about topic, it deserves a separate mention. Adani Group has acquired a lot of assets like ports, airports, gas stations, cement plants and electricity distribution rights over the last few years. In the process, it has accumulated debt to the tune of INR 2lac crores. Now, it is trying to deleverage its balance sheet by selling shares of one of the group companies.

Whether Adani is successful or not in the deleveraging endeavour, it doesn’t materially alter the overall trajectory of India’s economy or stock markets. This is because all Indian banks together have an exposure of less than 1lakh Cr to the Adani group and most of it is secured. Also, most mutual funds, PMS and investors have kept away from Adani stocks given the political risk involved. We find lot of similarities between Adani’s methods and that followed by Reliance & Birla’s in 80s & 90s or Korean giants like Samsung, LG and Hyundai in the last century.

Stable macro set-up; Budget can prove to be the turning point

Indian market was outperforming all the global markets until Dec’22, despite the constant FII selling. But since Jan’23, we have corrected a bit while the Chinese & European markets have done significantly better than us. Since India offers much better long-term stability & opportunity, there is a likelihood that once FIIs make money in China & Europe, they will come back to India. Also, it is a big relief for India that the oil, gas and metal prices have cooled-off since the Ukraine war.

Budget is usually a non-event for the markets, unless the government resorts to populist spending. The current government has made it clear multiple times, through their words & actions, that they would like to spend on infrastructure creation rather than distribute freebies. Experts who look at market technicals tell us that markets are very light before the budget (people are sitting on good cash levels) and any significant down move looks unlikely.

The banking sector is in fine fettle as can be seen by the good operating results posted by them and the optimistic commentaries about future. The infrastructure & industrial & energy sector is getting a lot of attention & resource allocation not just in India but globally as well. Companies in this space too are reporting good results and strong order books.

What can the investor do?

There is an old saying in investing that the best answer is never in terms of yes or no, but always in terms of probabilities. We are hoping that the above three paragraphs have done some justice to the possibilities of “is it a good time to invest more”!

One should not infer from the above analysis that there is absolutely no euphoria in the market. The pockets of euphoria (tech, startup, pharma, concept stocks etc) of 2020-21 may continue their downward journey for a few more quarters; the start-up balloon still has a long way to deflate; investors in the US stock markets may be disappointed for few more years; inflation will remain a factor to reckon with for a few more years. But the pertinent point is that many pockets of the Indian market are very healthy and investors in these pockets can expect decent returns over a period of time.

Trivia – Intelligence vs. Wisdom!

All of us have heard about the ills of gambling either from the ancient stories of Mahabharat or tale of Nala & Damayanti. The modern mathematicians too have highlighted the high probabilities of losing at the casinos in the famous quote “the house always wins”. Thanks to the cultural barriers & the awareness drives, large proportion of today’s educated youth do not indulge in traditional gambling. But like every other vice, traditional gambling evolved itself, re-packaged itself and caught the fancy of the youth in the recent years.

Yes, we are talking about the Futures & Option trading boom that gripped India since the start of pandemic! Crores of Indians opened trading & demat accounts on platforms like Zerodha, Angel, Upstox, etc. Most of them were lured by the low initial capital requirement and the “heads I don’t lose much, tails I win big” option strategies sold by the platforms and various influencers.

Anyone who has spent more than a decade in the stock markets, will know either from personal experience or from various study reports that majority of investors lose money in F&O. But looking at the frenzy, I consoled myself that maybe the educated younger generation is savvier & intelligent; that since the knowledge is easily available on internet via influencers & tutorials – they may not do as bad. However, a recent SEBI study highlighted that 95% of the ~40lac active traders suffered a net loss over the last 3 years and the average loss per person was 1.1lakh. The other 5% who made money, made a meagre 1.5lac on an average. Over the same time span, “the house” made handsome profits (Zerodha’s profits increased 4x to 2000cr, NSE’s profits increased 3x to 5000cr)!

This brings us to the debate between intelligence and wisdom. It is really easy to confuse the two. When you are young, intelligence generally ends up getting the better of you – reading success stories of few traders and attending few webinars make you feel that you can beat the house. The 14-year younger me could fully empathize with the enthusiasm & loss of the youth, but the slightly wiser me would think of two things – that these losses are “tuition fees” paid these youngsters to the markets for attaining some wisdom. And a wise investor should always invest with “the house”!

]]>Large import of oil, gas, gold & electronics has been the primary reason for India’s negative trade balance i.e., our total imports have always been higher than total exports. Historically, this situation gets aggravated when foreign investors sell their India holdings in large quantities and remit money

back to their home country. Hence, we have always witnessed violent corrections in our stock market, currency market and interest rates during global turbulence (1998, 2000, 2008, 2013, 2020).

But this time around, Indian stocks, bonds and currency have been remarkably stable. That brings us two very logical questions – 1) Is this stability a temporary phenomenon & is there a big fall lurking? And 2) Is this something durable and signifies a permanent improvement in India’s outlook? While only time can answer these questions with certainty, the data points emanating over past few quarters point to the latter i.e. permanent improvement in India’s outlook. Let’s delve a little more into these to understand the opportunities that can arise and the safeguards that are needed, should the thesis not work out.

Observation 1: Stable geopolitical situation!

Globalization got fractured over last two years when US & Europe tried to weaponize its payment systems (SWIFT) against Russia, China tried to weaponize its manufacturing dominance, Russia tried to weaponize its energy dominance over Europe and so on. India has largely stayed neutral and offered itself as an alternative manufacturing destination to all the MNCs that are overly dependent on China or Europe for sourcing.

This offer has been backed with meticulous preparation like PLI schemes, tax incentives, reduced red tape, easier land acquisition, labour reforms, atmanirbhar criterion for PSUs, etc. It is getting clear that if the last decade belonged to consumer, banking & technology, the current decade may

witness a boom in India’s manufacturing economy.

Observation 2: Low leverage, large domestic economy, and booming software exports!

India’s financial system witnessed multiple rounds of clean-up just before COVID (De-mon, GST, IBC,IL&FS). Also, unlike the west, the Indian Government did not indulge in a massive spending spree during COVID. Hence, the financial health of our banks, corporates, and central government is very strong. Also, thanks to our blessed agri resources, we are not overly dependent on the world for food. The steadily growing software & engineering exports have so far managed to offset the oil imports bill. All these factors are big contributors to India’s macro stability. Flare up in oil prices probably remains the only big risk to India story.

What are the implications for investors?

The blessed part about investing in India is that there is a natural growth embedded in our economy,thanks to the captive consumption of the large population and rule of law. Our delivered growthrates may be lower or higher than our real potential, but we are surely growing. In such an economy, we don’t have to rely much on complicated macro assessment to guide our investment decisions. We need to find few good pockets of opportunities, few good promoters and stay invested till the thesis is intact.

While the evergreen themes like travel, fashion, food, finance, lifestyle, and technology continue to remain good areas to invest, one must start paying attention to the energy transition &

manufacturing theme. India is trying hard to reduce its oil import as well as meet emission targets through various strategies.

Oil dependence can be reduced through ethanol blending, increased use of Electric and CNG vehicles. Creating infrastructure for these technologies would entail a lot of work for companies like Praj Industries, ISGEC, Alicon, Motherson Wire, Hitachi Energy, Ingersoll, Kirloskar Pneumatic, IGL, Techno Electric, Voltamp, BBL, Power Grid, etc.

Factory operations can be made more energy efficient through use of advanced boiler technologies and better rated components like motors, pumps and compressors. Factory affluents can be treated in FGD or ZLD unit before being discharged. There are dozens of companies that work in these areas.

If India can attract global players to manufacture in India, we will see a boom in construction of new factories. Most of the factories would require foundry, CNC machines, motors,pumps, compressors, bearings, steel, automation, logistic & warehousing services, etc.

Indian markets delivered ~11% CAGR over the last decade despite being plagued with scams & NPAs under the UPA; disruptive reforms like IBC, GST, NPCI under the NDA. We are now at a juncture where we will possibly enjoy the fruits of the pain taken over last decade. As such, long term investors can use globally induced corrections (there will be a few of them in the next twelve months) as opportunity to deploy more money.

Trivia – Corporate ESG v/s Personal ESG!

Environmental, Social, and Governance (ESG) has become a buzz word for nations, corporates, and investors over the last decade. So much that larger portion of company’s annual report or presentation is dedicated to ESG & CSR efforts in comparison to the business performance & initiatives. This talk is supplemented by the increased promotion of everything being clean, green, and responsible – clothes, cosmetics, energy, furniture, packaging, food, etc. The non-stop chanting may tempt you to believe that world is going in the right direction and mother earth has a chance to fight back.

The more we try to look beyond these clean and green claims, the more we realize that ESG is less about the environment and more about killing the guilt of excess consumption and spurring growth

for new industries like EV, Renewable, Home electronics, Fast Fashion, etc. The peak of ESG madness was revealed last month when one of our portfolio companies declared “we have sold a record number of pumps to biogas plants in Germany”. On further inquiry, we learnt that electricity generated from biogas has a high level of ESG compliance in Europe; the unfortunate part is that they are chopping off the forests to secure wood for these biogas plants!

The West has always paid lip service to environment & ecology. As India witnesses a manufacturing & consumption boom over the next decade, we hope we learn from our extant ancient ESG wisdom, most famously described by the two Sanskrit words “Vasudhaiva Kutumbakam” i.e. the whole world is a family. The ‘recycle’ part of ESG should hopefully generate a lot of interest in the coming decade. Currently, there are only a few companies that are into recycling of tyres, metal scrap, plastic bottles, car batteries and e-waste. If commodity prices stay high for long enough, this sector will see a lot of traction.

The reduce & reuse part of ESG is more of a personal choice for most of us. Just like the CEO of Fairphone mobiles once said, “the most sustainable phone available is the one you already own”, we too have a positive bias towards these aspects. Not owning an additional property, car, credit card,

memberships, etc has not only freed-up much of my mental bandwidth but also enhanced our health & wealth situation.

For long term investors like us, falling markets are time for mixed emotions. The fear of mark down in portfolio values is interspersed with hope of buying long-awaited stocks at attractive prices. But this time, the emotions are tilting more towards relief that falling markets will bring sanity back to the world of business & investing. Relief that focus is changing from “growth at any cost” to “growth with profits”; that speculative areas of the market like meme stocks, cryptos, unicorns, etc will get lesser attention; that every new company or IPO or tech start-up will not be touted as the next big disruptor.

One can ascribe various reasons for the market correction like inflation, tightening by US Fed, Ukraine war etc, but the most common reason for any stock market party to end is that the prices had run-up far ahead of business fundamentals. It is hardly surprising to see the poster boys of the pandemic party i.e. tech stocks, new-age companies, chemicals, cryptos, etc seeing the steepest fall. The point of this article is not to bash up these stocks & their investors but to see if this phase offers any insights or opportunities for the future.

Insight 1: Excesses never go unpunished!

It would have been impossible to imagine in Jun’20 that exciting companies like Zoom, Facebook, Shopify, ARKK Innovation etc, would end up giving lower returns than boring but stable companies like Nestle & Dabur. In India, similar value erosion has happened across many themes – new age stocks like Zomato, Cartrade, Nazara; narrative stocks like Neuland, Sequent, Solara etc; super expensive stocks like Bajaj Finance, CDSL, Dmart, Divis, Dr Lal; 2nd rung companies like Lux, IDFC Bank, etc. History is again trying to teach us the same lesson “what comes easily also goes away easily”

Insight 2: It is never all good or all bad!

It’s rarely the case that all pockets of the market are in bubble zone or in value zone at the same time. There are always pockets that one should be careful of and pockets that one can be optimistic about. In the Indian context, the bubble was in start-ups, new IPO listings, pharma, chemicals, commodities, electric vehicle & green energy related stories and many export-oriented stories. Correction has begun but it could still be some more time before they reach their fair values.

On the other hand, there is little euphoria in sectors like banking, auto & ancillary, durables, industrials, real estate, resources, etc. These spaces can do well once India’s informal economy recovers from the Covid shock. Sectors like home improvement, travel and fashion should continue to remain evergreen.

Insight 3: Inflation is here to stay, prepare for it!

In all our past articles, we have never spent much time on macro topics like inflation, currency, interest rates or money supply since all those indicators were benign. But something has structurally changed in the post-pandemic world which makes us believe that inflation deserves deeper attention. This time, inflation stems from demand as well as supply factors. On the demand side:

The stimulus packages of the western economies have created excessive demand for electronics, cars, homes, home interiors, energy, etc. Also, the developing countries like India, Brazil, Vietnam etc, are fully opening up post pandemic and the postponed demand is coming back.

China’s geopolitical dealings during COVID and US & Russia’s cold war-like behaviour recently have exposed the fault lines in global supply chains. Many countries will strive to have self-reliance in areas like food, energy & electronics and build factories, power plants and strategic storage reserves. This will consume a lot of resources.

On the supply side, the stickiness seems more glaring as it comes from deeply entrenched structural factors that have no immediate solution. Europe is facing record shortages for things as basic as gas & electricity. Below are some of the supply side reasons:

The ESG focus & clean energy narrative ensured very little investments have been made in conventional areas of mining, oil & gas exploration, refining, blast furnaces, etc. Even if we decide to start investing, it takes years for these projects to start production (A copper mine takes at least 10 years from conception to first batch of production).

China had a big role in controlling global inflation in the past 30 years. Government incentives, cheap labour and relaxed environmental regulations ensured that China supplied cheap goods to the whole world. But that is changing now, as labour costs in China are rising rapidly (thanks to one-child policy, the average youngster is much more affluent v/s their parents who worked long hours in factories). Also, as affluence in Chinese society is rising, they are demanding cleaner cities and the government is responding by tightening environmental laws.

For the sake of our environment, we too were hoping that the era of fossil fuels would soon come to an end. But the reality is that renewables contribute less than 5% of global energy needs as of today. Electric Vehicles contributed to only 3% of total cars sold in the US in 2021, remaining 97% will still need gasoline while they are on the road for at least a decade or so. Also, let’s not forget that the clean energy transition will need a hell lot of steel, aluminium, copper, cobalt, nickle, lithium, polysilicon, etc – all of which requires more mining and smelting activity.

Clearly, the world stopped investing in conventional sectors way ahead of time and there is little option but to revive some of these investments. Stocks in these sectors are cheap and could get a fresh bout of life. Another consequence of high inflation could be that many consumer facing companies will not do as well in this decade as they did in the previous decade.

Trivia – Normal inflation vs aspirational inflation!

In a growing country like India, inflation has always been around, like the background music in a restaurant – you won’t notice it unless it’s too loud. Our folks will occasionally whine about rising prices of tomatoes, Amul butter, petrol, etc (can’t resist mentioning the scene from 3 idiots at Raju’s place) but it hardly affects their or our consumption patterns. Our earlier generations hedged themselves against inflation by buying physical assets like gold, house or land and it worked well for them (until 2014). Unfortunately, it’s not so straightforward for our generation to ape this.

Firstly, land & residential housing is still over-valued in most of the cities and may not deliver 6-8% returns. Secondly, the inflation rate for the young affluent class is at least 2-4% higher than the 6-8% rate published by RBI, courtesy the subconscious aspiration to keep upgrading our lifestyles. We have all witnessed this from close quarters – brand domination in bathroom shelves has changed from HUL to Body Shop to Forest Essential; wardrobes have changed from Fashion Street/Chandni Chowk to FabIndia & Zara; cars have changed from Maruti to Morrison Garages; healthcare has shifted from local doctor to Metropolis or Max or Apollo; vacations have evolved from native place to Taj & Airbnb.

A striking feature of this “aspirational inflation” is that it is extremely persistent till we reach our 50s. Very few can break-out of the cycle of aspirational inflation, so it’s best to acknowledge it and plan for it. An elderly investor enlightened us in 2014 that one need not be scared of aspirational inflation, rather it can be the best hunting ground for ideas for long term investing. We wrote about this in our 2014 article. Between then and now, stocks of more than a dozen companies that provide better housing, food, fashion, vacation, etc have given higher returns than the aspirational inflation number!

]]>

Cyclicality in microfinance sector is as old as the sector itself. A good cycle usually lasts for few years and is inevitably followed by bad cycle. The sector witnessed its worst cycle over 2019-21 courtesy the build-up that happened over 2017-19 and the disruptions caused by the pandemic. Over the past two years, most MFI players have provided for or written-off around 10-20% of their portfolios.

Credit losses of MFI players

| % of loans | FY19 | FY20 | FY21 | FY22* | FY23e | FY24e | |

|---|---|---|---|---|---|---|---|

| Bandhan | 1.9% | 2.4% | 4.9% | 8.4% | 1.5% | 2.0% | |

| Credit Access | 1.2% | 2.5% | 6.0% | 4.3% | 1.5% | 1.5% | |

| Spandana | 1.2% | 4.9% | 8.6% | 6.3% | 2.0% | 2.0% | |

| Arman | 1.1% | 2.6% | 6.5% | 3.1% | 1.5% | 2.0% | |

| MAS Financial | 2.1% | 1.5% | 1.0% | 1.1% | 1.1% | 1.1% |

*Annualized as on Dec21 or Mar22, whichever is available

Amidst all this, the good news is that we are nearing the end of the bad cycle; many MFIs are solvent even after absorbing such high losses; and the macros are turning favorable (since India’s informal & rural economy is finally recovering from the pandemic shock). For NBFC-MFIs, this is an additional positive due to the recently announced RBI guidelines. We can expect 18-24 months of strong growth and profitability for the sector in general and NBFC-MFIs in specific.

Profits for most of NBFC-MFI can double from the low base of FY22 just out of credit losses reverting to pre-pandemic levels (good cycle). In our assessment, most of the players will be able to grow between 15-30% CAGR over next two years and that can provide an even bigger boost to profits. The future assumptions in the above & below table are purely for illustrative purposes and should not be construed as an accurate projection.

Profit potential of MFI players

| INR cr | FY19 | FY20 | FY21 | FY22* | FY23e | FY24e | |

|---|---|---|---|---|---|---|---|

| Bandhan | 1,952 | 3,024 | 2,205 | (1,777) | 5,150 | 6,250 | |

| Credit Access | 322 | 328 | 131 | 350 | 900 | 1,163 | |

| Spandana | 309 | 337 | 129 | 100 | 385 | 450 | |

| Arman | 26 | 42 | 11 | 30 | 70 | 100 | |

| MAS | 143 | 167 | 144 | 115 | 200 | 250 |

*Annualized as on Dec21 or Mar22, whichever is available

Let’s turn our attention to individual players. MFI is cyclical business and being adequately capitalized helps during downturns. Also, MFI is a very operations intensive business i.e. it involves heavy reliance on employees, frequently meeting the customers, and maintaining the sanctity of everyday processes. The MFIs with robust operations usually enjoy higher profits in good times and suffer lesser losses in bad times. This is precisely the kind of player you may want to invest in.

How the valuations stack up

| P/B (x) | ||||

|---|---|---|---|---|

| Company | CMP | M Cap | on FY22 | on FY24e |

| Bandhan | 330 | 53,099 | 3.4 | 1.8 |

| Credit Access | 985 | 15,295 | 3.7 | 2.5 |

| Spandana | 445 | 3,068 | 1.1 | 0.8 |

| Arman | 1,150 | 976 | 4.5 | 2.2 |

| MAS | 621 | 3,396 | 2.7 | 2.0 |

Bandhan Bank is India’s largest MFI and was also the worst impacted. Some of the reasons for this were its high concentration in West Bengal (46%) and Assam (14%), high ticket size of loans and underinvestment in non-MFI businesses. While there is no denying that there will be a cyclical recovery in profits, long term investors in the stock have to grapple with the above-mentioned structural issues. Another point working against Bandhan Bank is its bloated equity base, courtesy the super expensive acquisition of GRUH Finance. This will further increase in FY23 as it will need to raise capital for growth.

Credit Access Grameen is India’s largest NBFC-MFI and also one of the best run MFIs. It boasts of the lowest credit losses in the pandemic period (10% of loan book) despite having acquired a mid-sized MFI just before the start of pandemic. Operating in rural areas and following the best practices in terms of collections & customer leveraging, Credit Access is the cleanest play in the NBFC-MFI space. Current valuations partially reflect rosy future, but compounding returns are still possible.

Spandana is bitter sweet story – it was the only MFI that survived AP crisis & emerged from CDR, thanks to the efforts of its founder-promoter and the capital support given by Kedaraa Private Equity. However, an ugly corporate battle broke between the founder promoter and the private equity in late 2021. Although Spandana is well capitalized and well provided, such altercations can impact ground operations. The MFI upcycle has started; stock is trading at throwaway valuation; only if the quarreling promoters can resolve the differences, Spandana has many low hanging fruits that it can pluck.

Arman is very small but well-run MFI. It ticks many boxes including good geographic diversification and highly profitable operations. The only problem here is the low float and rich valuations. The company has to grow at 50% CAGR for investors to make meaningful money from current prices.

MAS Financial is engaged in the business of wholesale lending to hundreds of MFIs and small NBFCs. However, MAS couldn’t reduce its own borrowing costs meaningfully over the years and is facing competition from many large NBFCs in this segment. It is substantially under-invested in direct lending and valuations are not cheap either.

Things to ponder for the long term!

The upcycle has started for sure, but the extent and duration will depend on several factors like growth in household incomes, competitive intensity, liquidity, etc. In the past, we have seen that the urge to grow fast has led to indiscriminate lending by banks as well as NBFC MFI players, in turn resulting in customer over-leverage. A look at the below table can summarizes the customer overleverage that transpired in the microfinance sector in the five years preceding the pandemic.

| 2016 to 2020 | Total growth |

|---|---|

| Loans outstanding | 125% |

| Ticket size growth | 106% |

| Rural wage growth | 23% |

Source: Economic Times, MFIN, SADHAN

In the past, RBI’s efforts to contain this have been cleverly circumvented. Let’s hope that the new guidelines are followed in spirit as well and the sector can witness a longer upcycle. Otherwise, it will be difficult to have a long-term view on the sector as well as the stocks. Investors can also consider investing in short term bonds of lenders like Credit Access, Spandana, Asirvad, etc since they offer immense safety and good yields.

All through the last 10 years, there has been a simple linkage between gold price and the perception of performance of gold loan NBFCs. If gold prices went up, stocks of gold loan NBFCs like Muthoot & Manappuram would do well and vice-versa if the prices went down. This simple correlation was based on the understanding that if gold prices go up, loan growth improves, operating leverage kicks-in, auctions reduce and profitability improves.

Thumb rules work, till they stop working: The above-mentioned correlation seems to have broken down in last twelve months. The stock prices of Muthoot and Manappuram have been weak despite the 10% improvement in gold prices and the improved outlook for gold (due to inflation and the war related uncertainties). One can argue that the weak performance of these stocks could be due to the muted growth & high auctions in the past 2-3 quarters. But one can immediately counter argue that stock prices are more reflective of what can happen in the future and that future growth prospects for gold loan sector looks bright given the firmness in gold prices and opening up of Indian economy. What then explains the underperformance?

Competitive intensity is the joker in the pack: Over FY15-20, retail gold loan sector was growing at mere 8-10% CAGR and accounted for less than 1% of India’s total outstanding loans. This coupled with operationally intensive nature of gold loan business ensured that most banks stayed away from this segment and specialized NBFCs were able to not only grow well but also improve their profitability to remarkable levels.

| Muthoot Finance | Mar-16 | Mar-17 | Mar-18 | Mar-19 | Mar-20 |

|---|---|---|---|---|---|

| Loan book (bn) | 243 | 272 | 288 | 366 | 408 |

| RoA | 3.4% | 4.4% | 5.9% | 5.6% | 7.4% |

| Manappuram | Mar-16 | Mar-17 | Mar-18 | Mar-19 | Mar-20 |

| Loan book (bn) | 66 | 91 | 100 | 116 | 205 |

| RoA | 3.3% | 6.0% | 4.6% | 5.3% | 6.6% |

This goldilocks scenario seems to have been disturbed with many new players entering the gold loan arena. As we can see from the table below, relatively new entrants like SBI, CSB, Federal Bank, Fed Fina, etc have created decent sized gold loan portfolios. To add to this, there are players like ICICI Bank & Bajaj Finance who have also joined the bandwagon but do not report the gold loan AUMs separately.

| Loan book (bn) | Mar-19 | Dec-21 | Increase (x) |

|---|---|---|---|

| Incumbents | |||

| Muthoot Fin | 336 | 542 | 1.6 |

| Muthoot Finorp | 130 | 205 | 1.6 |

| Manappuram | 116 | 205 | 1.8 |

| IIFL | 63 | 146 | 2.3 |

| Incumbents | |||

| SBI | 14 | 221 | 15.8 |

| CSB | 30 | 58 | 2.0 |

| Fed Bank | 17 | 54 | 3.2 |

| FedFina | 4 | 21 | 4.8 |

| DCB | 5 | 16 | 3.2 |

Lending yields are currently under pressure: Until 2020, it was believed that banks will not venture into gold loan business meaningfully due to operationally intensive nature of the business. But given that most lending avenues were running dry post IL&FS crisis in Sep18, many banks have started to look at this niche and highly profitable lending segment. While SBI & CSB rely on internal resources to run the gold loan business, Federal Bank, Karur Vysya and ICICI Bank have entered into symbiotic relationship with start-ups like Rupeek & Indiagold to do the front-end for them.

| Yield | Mar-20 | Mar-21 | Dec-21 |

|---|---|---|---|

| Muthoot Fin | 23.0% | 22.2% | 20.6% |

| Manappuram | 25.4% | 24.9% | 20.3% |

| IIFL | 19.4% | 19.1% | 17.4% |

All this has resulted in price war between banks & NBFCs and within NBFCs too and yields for NBFCs have been under pressure. At the peak of the price war in Sep’21, many banks and NBFCs were offering large ticket gold loans at 6-8%!

Is the damage temporary or permanent: Stock prices of Gold loan NBFCs look cheap even if one looks at them on TTM P/E ratio. The subdued stock prices for Muthoot and Manappuram despite attractive valuations seems to be Mr. Market’s message to investors – “competition is here to stay, the best of lending yields & profitability are behind us, let us wait and watch as to how much lower do the settle”

1. Muthoot Finance is the gold standard in gold loan segment with best-in-class brand, liability profile and operating cost structure. While there is little doubt that it will remain the leader in the coming decade as well, but profitability (RoAs) over the coming years will probably settle at 100-150bps lower vs FY21 levels. Competition in 2lac+ ticket size is here to stay as a leader, Muthoot will have no option but to keep fighting in this segment. The less than 1lac ticket size represents a large & profitable opportunity, but the branches have to keep running to maintain & grow this part of the loan book.

2. Manappuram Finance has a much tougher job at hand. Its higher operating costs (2x v/s Muthoot) will not allow it to compete in the 2lac+ ticket size and it will have to do the hard work of originating smaller ticket sized loans, where yields are still upwards of 18%.

3. IIFL Finance is somewhat in a sweeter spot because it never had sky high RoAs in the first place. And the old branches have reached critical mass needed to keep operating costs low.

Make no mistakes that this is not a start-up driven disruption. The gold loan start-ups continue to burn money and are yet to come up with any path-breaking innovation on any aspect of gold loan business. The competition seems to be from banks in general and in some cases, the symbiotic partnership between start-ups and banks.

The bull, bear & base cases: The bull case for gold loan NBFCs seem to be that the competition is temporary and we will see a sharp bounce back in growth & profitability. The bear case represents sustained increase in competition and 2-to-3-year period of yield compression. In that case, multiples will de-rate further unless they are able to diversify into new areas of lending. The base case is that the profitability adjustment phase ends in a few quarters, RoAs will settle around 5-6% range, and there is enough room for everyone to grow at 10-15% CAGR. In this case, the stocks will continue to underperform / consolidate. Currently, we are neither in the bull or the bear camp and will stick to the base case.

Note: The data used above has been taken from company presentations or annual reports. We would like to thank our friends working in gold loan industry for helping us decipher the trends and plugging the gaps in our understand. If you have any observations on the above article you write to us on [email protected]

]]>The above title pretty much summarises the investor experience in stock markets over past 18 months. Markets continue to celebrate even the smallest of positive developments like revenge travel, re-opening of cinemas or the rise in valuation of start-up unicorns. Business media, Twitter & Instagram are full of positive interpretation even around the not-so-positive developments like:

• Rising inflation (is good because farmers & miners will earn more!)

• Slow recovery in unemployment (people are enjoying life & not returning to work!)

• Slowing down of Chinese economy (China’s loss is India’s gain!)

• Staggering debt levels of global central banks (why should I care when I have no debt!)

• Record IPO valuations of loss-making unicorns (but India’s getting its own FAANG brands!)

So easy has it been to make money in stock markets post Apr’20 that new investors have been flocking there in hordes. A case in point is the small town called Barpeta in Assam, which managed to open more trading accounts than Hyderabad and even Ahmedabad! Many of the newbie investors have witnessed long streak of winning trades and that has encouraged them to start their technical trading & investment advisory business on whatsapp, twitter, youtube, telegram, etc.

It’s a different matter that Barpeta folks have been lured with prospect of making 3000 to 5000 rupees every day on a capital investment of merely 50,000 and that strategies of some of these new breeds of advisors have been back-tested for only 3-5% market falls. The purpose of this article is not to worry about the investors of Barpeta or new breed of advisors or their followers. Time will ensure that everyone will learn the right lessons. The purpose is to re-access some of our actions, assumptions and expectations even as we celebrate the current phase of positivity.

Is the current phase of positivity unjustified?

A black or white answer to the above question is not only difficult but also futile for long term investors like us. The markets and economy are always a concoction of positive & negative things. Currently, the pace of vaccination, absence of 3rd wave, boom in start-up & tech sector, revival in corporate profits, record tax collection, opening-up of economy, etc can be seen as positives. On the other side, weak informal economy, unemployment at 2x of pre-covid levels, muted 2-wheeler & car sales, supply chain constraints, inflation, possibility of stagflation, etc can be seen as negatives. And each of these things are constantly evolving!

Thankfully, long term investing does not require us to have accurate views on any of the above. Investing can be as simple as buying a good business at a good price. Over the past 18 months, prices of large number of stocks have risen significantly; in many cases, prices have gone up way more than profit growth & future potential of those companies. Hence, it may be prudent to trim exposure to over-priced stocks in our portfolios. High prices can be strong enough a reason for the party to end! We have seen that happen in the Japanese real estate market in early ‘90s, the dot-com burst in ‘99, the Sensex story of 2010-13 and more recently in a stock called IRCTC.

Are there pockets of euphoria that one must stay away from?

While there is no clear definition as to what constitutes “euphoria”, there are a few common patterns observed in most bubbles – the stock or sector is seeing sudden surge in profits, most likely due to inventory gains; these high operating margins are expected to sustain in the future or; businesses are loss making today but valued based on abstract ideas like large addressable market, earnings potential of 2030; or stocks are touted as India’s Paypal/Netflix/Alibaba or even next HDFC/Titan.

Currently, we are seeing such signs in companies belonging to sectors such as specialty chemicals, pharma, green energy, building materials, tech-platform (Zomato, Paytm, Policybazzar, Nazara, Indiamart, etc) and not to forget Cryptocurrencies! Some of them may be good business models, but surely, they have run ahead of their fundamentals and need to rest.

An analysis of Paytm (weak business model, very high price)

After a failed wallet & e-commerce business, Paytm has now focused its energies towards the loss-making payments business. Paytm is still burning crores to acquire merchants as well as retail customers and ensure that people use their platform to make payments, in the hope that someday, Paytm can cross sell loan, investment and insurance products to this large customer base. Thus, for all the big buzz words like superapp, network effects, wealth-tech, insurtech, Paytm is going be an “agent” in the future that earns commissions out of selling loans, mutual funds, insurance, etc!